In the realm of finance, particularly concerning risks and liabilities, the Certificate of Insurance (COI) emerges as a quintessential document. Its significance is often underestimated, yet it serves a pivotal role in defining the contractual landscape between parties engaged in various transactions. This article elucidates the nuances of an individual financial COI, offering a comprehensive exploration of its implications and intricacies.

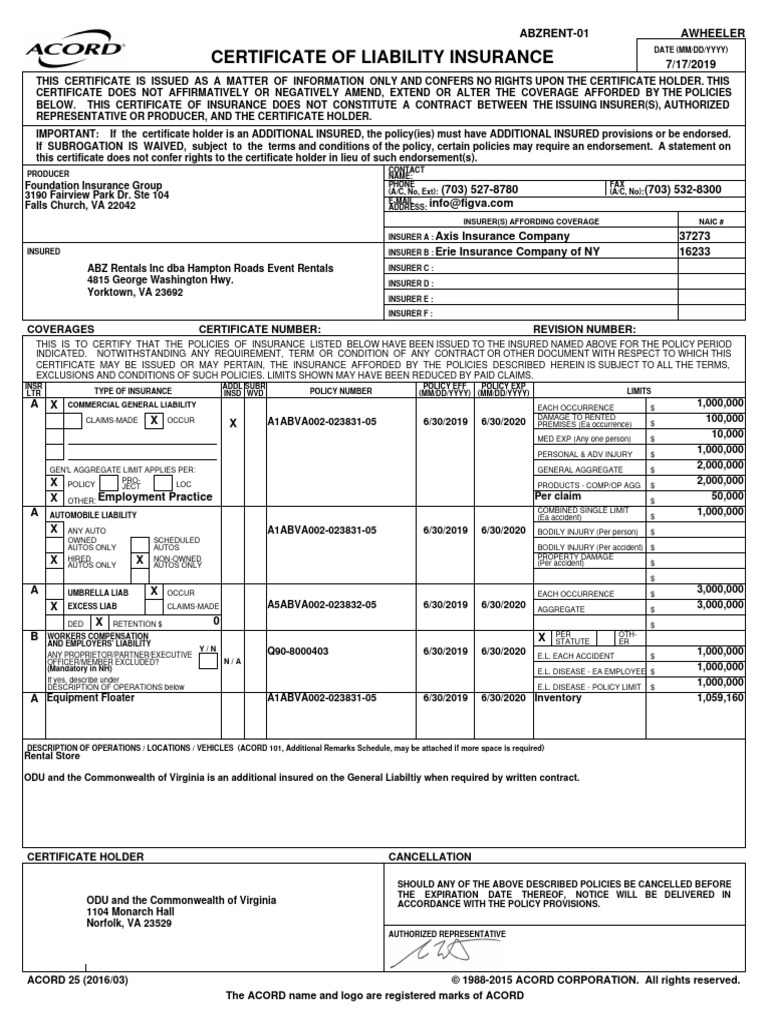

At its essence, a Certificate of Insurance is a document that provides proof of insurance coverage. It outlines the critical details of an insurance policy, including the insured party’s name, the type of coverage, policy limits, and the effective dates. In individual financial contexts, such as personal liability or private business dealings, the COI operates as a safeguard against potential financial losses stemming from unforeseen events.

One might marvel at the ubiquity of COIs in our everyday transactions. Consider the situation of renting a venue for an event. The venue owner often requests a COI from the renting party, stipulating that their property is safeguarded against any liabilities that may arise during the event. This simple requirement hints at a deeper societal reliance on the assurance that one party will compensate another in the event of a mishap. It reflects a culture where individuals seek to mitigate risk and uphold accountability.

The allure of the individual financial COI lies in its multifaceted nature. It doesn’t merely exist as a bureaucratic formality; rather, it symbolizes trust and responsibility. Beyond the surface, it subtly addresses the anxieties surrounding personal exposure to financial liability. When an individual presents a COI, it demonstrates a commitment to safeguarding the interests of others, promoting a sense of security in transactions. This is especially true in settings where high-stakes investments or agreements are involved.

To further comprehend the intricacies of a COI, it is imperative to dissect its components. A typical COI consists of several key elements:

- Insured’s Name and Address: The document identifies the individual or entity protected under the policy, forging a unique connection between the insurer and the insured.

- Insurance Provider: The name of the insurance company providing coverage is disclosed. This detail assures the other party that the coverage is legitimate and backed by a reputable firm.

- Types of Coverage: Various types of insurance may be listed—general liability, professional liability, or property damage, to name a few. Each coverage type caters to specific risks, thereby illustrating the insured’s preparedness to face potential liabilities.

- Effective Dates: The COI delineates the policy’s inception and expiration dates, ensuring the other party is aware of the temporal scope of the coverage.

- Additional Insureds: In certain situations, the COI may list additional parties covered under the policy, enhancing the layers of protection afforded.

Upon closer examination, it becomes apparent that the COI is not merely a static document; it is a dynamic instrument that evolves with the insured’s circumstances. As life unfolds—whether through career changes, personal ventures, or varying degrees of risk exposure—the insurance policies and, consequently, the accompanying COIs must be reassessed and updated. Individuals are often compelled to adapt their coverage to reflect these changes, promoting an ongoing dialogue about risk management.

This ongoing negotiation with risk extends into the very psyche of individuals. The need for a COI can underscore deeper feelings of vulnerability. In a world rife with uncertainties, the desire for insurance and, by extension, a COI signifies a yearning for control amidst chaos. People are compelled to engage in risk assessment, evaluating their personal exposure and the ramifications their decisions might yield.

A COI also plays a significant role in professional environments where trust must be established promptly. Contractors, consultants, and freelancers frequently rely on COIs to validate their legitimacy. A COI serves as an emblem of professionalism, assuring potential clients that risks are adequately managed. This becomes particularly relevant in industries where the stakes are high; the assurance provided by a COI may very well secure a contract or project.

Moreover, the impact of technology on the issuance of COIs cannot be understated. With advancements in digital documentation and verification processes, individuals can now procure COIs more efficiently. This streamlining reflects a broader trend in financial services, where accessibility and immediacy become paramount. The advent of online platforms allows individuals to present their COIs quickly, fostering trust in transactional environments where promptness is critical.

The fascination surrounding the individual financial COI is not merely rooted in its functionality; it also resonates with broader themes of risk mitigation, accountability, and societal expectations. The COI serves as a microcosm of our desire for reassurance in a world punctuated by uncertainties. It promotes a culture of responsible financial management, where individuals proactively shield themselves and their interests from potential liabilities.

In conclusion, the Certificate of Insurance emerges as a profound reflection of our interactions with risk and responsibility. As an individual navigates through the complexities of personal finance and contractual obligations, the COI becomes an indispensable ally. It embodies a commitment to uphold duty and accountability, reinforcing societal norms centered on trust and assurance. By understanding the significance and layers of an individual financial COI, one can appreciate its essential role in the delicate dance of risk management in everyday life.