The cash flow statement is a critical financial document that provides profound insights into a company’s liquidity, solvency, and overall financial health. By dissecting the cash movement within an organization, stakeholders can assess the efficacy of operational activities, investment expenditures, and financing decisions. This comprehensive guide will elucidate various aspects of a cash flow statement, illustrating its components, significance, and practical examples for better understanding.

At its core, a cash flow statement delineates the cash generated and expended during a specified period. Unlike the income statement, which may include non-cash items, the cash flow statement zeroes in on actual cash transactions. This distinction is paramount as it provides a clearer picture of a business’s operational efficiency. Typically, the statement is structured into three principal sections: operating activities, investing activities, and financing activities.

Understanding the Components

The structure of a cash flow statement is typically straightforward, yet the implications of its components are intricate and multifaceted. Each section reveals a particular aspect of how financial resources are managed.

1. Operating Activities

The operating activities section reflects cash transactions related to the primary business operations. It encapsulates cash inflows from sales of goods and services, as well as cash outflows for expenses, such as salaries, rent, and utilities. This section can be directly or indirectly calculated.

In the direct method, every cash received or paid is recorded, presenting a clear enumeration of cash inflows and outflows. Conversely, the indirect method adjusts net income for changes in non-cash items and working capital. For example, an increase in accounts receivable indicates that not all revenues have been collected, thus reducing cash flow.

2. Investing Activities

Investing activities indicate cash spent on or generated from investments in long-term assets. These include purchases and sales of property, equipment, and investment securities. Understanding this section is crucial for evaluating how a company allocates resources to foster future growth.

For instance, if a company invests heavily in new technology, it signals a commitment to innovation, albeit at the cost of short-term liquidity. Alternatively, selling off underperforming assets can bolster cash reserves but may not always reflect positively on the company’s operational viability.

3. Financing Activities

This section presents cash transactions related to funding the business. It encompasses cash inflows from issuing stocks or bonds and cash outflows for dividend payments and repaying debt. Analyzing this section provides insights into the company’s capital structure and financial strategy.

If a firm significantly increases its debt load to finance expansion, it may indicate aggressive growth tactics. However, excessive reliance on debt could also highlight potential solvency risks, making it essential for stakeholders to scrutinize this aspect meticulously.

The Significance of Cash Flow Statements

A cash flow statement is a treasure trove of information that aids diverse stakeholders, including investors, creditors, and management. For investors, it uncovers the company’s ability to generate cash from operations, a key determinant of financial sustainability. Conversely, creditors assess the statement to gauge a firm’s capacity to meet its financial obligations.

Management relies on cash flow statements to make informed decisions regarding budgeting and financial planning. By analyzing cash flow trends, they can identify operational inefficiencies, forecast future cash needs, and strategize funding approaches. This proactive management of cash resources is indispensable for sustaining long-term growth and profitability.

Analyzing a Cash Flow Statement: An Example

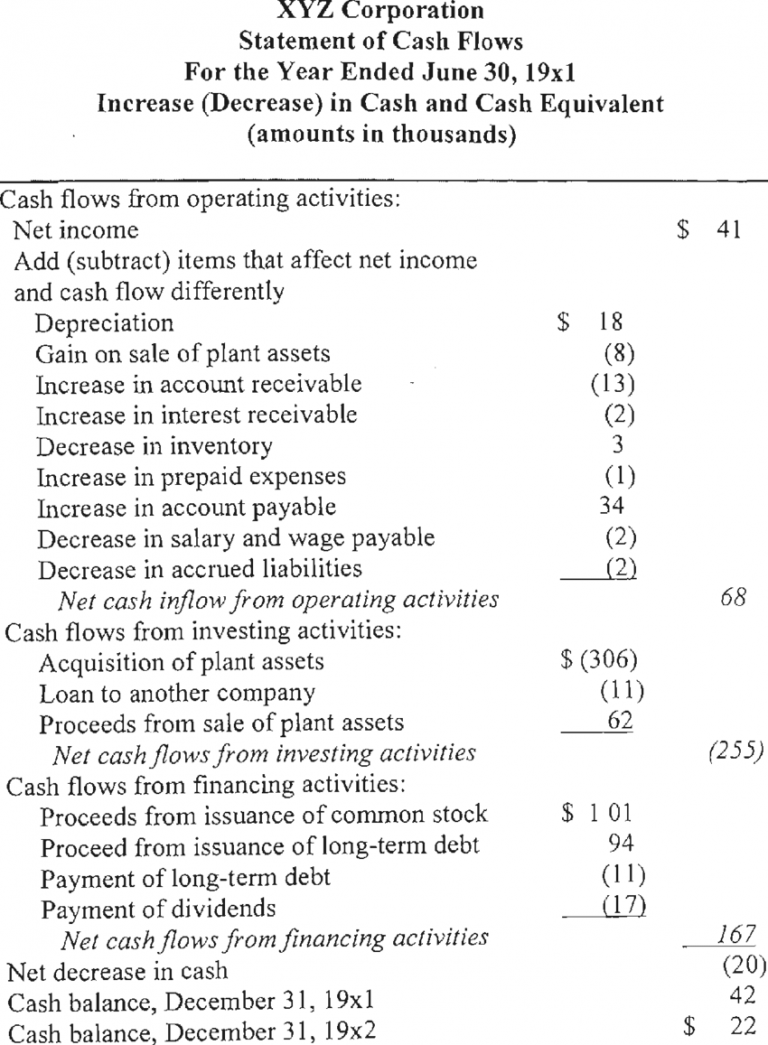

To contextualize the theoretical underpinnings, let’s consider a hypothetical company, XYZ Corp. Below is a simplified version of its cash flow statement for the fiscal year:

Operating Activities: Cash received from customers: $500,000 Cash paid to suppliers: ($300,000) Cash paid for operating expenses: ($100,000) Net cash provided by operating activities: $100,000 Investing Activities: Purchase of equipment: ($50,000) Sale of investments: $10,000 Net cash used in investing activities: ($40,000) Financing Activities: Proceeds from issuing stock: $70,000 Payment of dividends: ($20,000) Net cash provided by financing activities: $50,000 Net increase in cash: $110,000

This example elucidates how different cash flows interplay. The operating activities reveal a positive cash inflow, stating that XYZ Corp. effectively converts its sales into cash. However, investing activities show cash spent on equipment, indicating future growth investments, which is often a prudent choice despite short-term cash outflow. Finally, the financing activities highlight a strategic equity raise to bolster the cash reserve while balancing shareholder returns through dividends.

Conclusion

A cash flow statement is more than a mere financial report; it is a narrative of a company’s operational prowess and financial acumen. Grasping its components and significance enables stakeholders to derive meaningful insights into a firm’s liquidity and sustainability. By carefully evaluating cash flow patterns, businesses can not only navigate financial challenges but can also capitalize on growth opportunities. Whether for investment analysis, credit assessment, or managerial decisions, the cash flow statement remains an indispensable tool in the financial toolbox.