The profit and loss statement, often referred to as the P&L statement, embodies the financial narrative of a business, encapsulating its operational prowess over a specific period. This essential financial document serves as both a compass guiding organizational strategy and a mirror reflecting past performances. To delve deeper into its significance and intricacies, one must appreciate its components and understand how it manifests the financial health of a business.

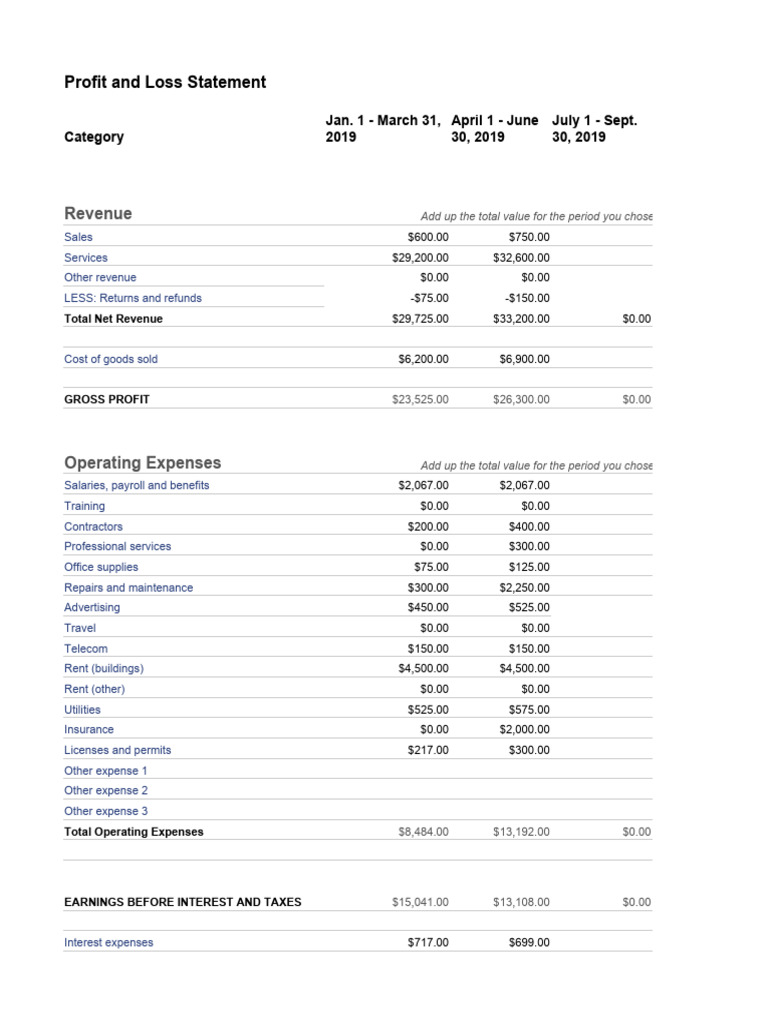

The journey begins with the understanding of what constitutes a profit and loss statement. Essentially, this document highlights revenues, costs, and expenses, culminating in the net profit or loss during the reporting period. It’s a quantifiable assessment of a company’s efficiency and viability, both of which are critical metrics for stakeholders, from investors to management teams. The foundation of this statement rests on four pivotal elements: revenues, cost of goods sold (COGS), operating expenses, and non-operating revenues and expenses.

Revenues, commonly known as sales or top-line earnings, denote the total income generated from normal business operations. This figure is paramount, as it lays the groundwork for subsequent calculations. Understanding the nuances of revenue generation helps stakeholders decipher the company’s market position, customer base, and competitive edge. It is crucial, therefore, for businesses to maintain transparent and accurate reporting of their income streams.

Next, we encounter the cost of goods sold (COGS), which represents the direct costs attributable to the production of goods sold or services provided. This encompasses everything from material costs to labor involved in manufacturing. The relationship between revenues and COGS is pivotal; a higher COGS reduces gross profit, which can indicate potential inefficiencies in production or supply chain management. Analyzing COGS alongside industry benchmarks can unveil opportunities for cost management and efficiency improvements.

As we traverse further into the P&L statement, we arrive at operating expenses, a category that encompasses all costs not directly tied to producing goods or services. Operating expenses include administrative costs, salaries, utilities, and marketing expenses. This segment of the statement provides an invaluable insight into a company’s operational strategy and discretionary spending. A detailed examination here can spark curiosity regarding how effectively a company allocates resources, seeks to optimize expenditures, and employs operational leverage to enhance profitability.

Non-operating revenues and expenses, the last component, deserve special attention as they reflect income and expenses not directly tied to a company’s core operations. This could include investment income, interest expenses, or gains and losses from asset sales. Recognizing these figures is crucial for a holistic understanding of a firm’s financial performance, as they can skew the overall perception of profitability if not carefully analyzed.

When the aforementioned elements are synthesized, one arrives at the net profit or loss figure. This bottom line is an unequivocal indicator of a company’s financial success or challenges. It narrates the tale of resource allocation efficacy, pricing strategies, and market conditions. Positive net income symbolizes a successful business operation, while a negative figure demands scrutiny and strategic recalibration. Herein lies the beauty of the P&L statement—a succinct distillation of a multi-faceted business landscape.

Intriguingly, a well-constructed P&L statement does more than just convey numerical data; it serves as a narrative that evokes curiosity and ignites conversations about future trajectories. The analysis of historical figures can shed light on trends, while comparisons across different time frames can elucidate growth patterns or demonstrate potential downturns. Investors and management alike should be in relentless pursuit of such narratives to make informed decisions.

To illustrate the utility of a profit and loss statement, consider its application in strategic planning. By comparing year-over-year financial performance, organizations can unearth valuable insights into seasonal variations, consumer behavior, and market dynamics. For instance, if a company notices declining revenues in a particular quarter consistently over the years, it may warrant a pivot in marketing strategy or a reevaluation of product offerings during those months. Such proactive measures can significantly enhance a company’s resilience and adaptability in an ever-evolving market landscape.

The importance of a profit and loss statement extends beyond internal evaluations; it is also a critical document for external stakeholders. Creditors and investors utilize this statement to assess a company’s ability to generate earnings and service debt. A transparent and detailed P&L statement can bolster a company’s credibility and facilitate smoother financial transactions. Subsequently, it enhances the perception of the company as a viable investment opportunity, opening doors to potential funding or partnership arrangements.

Furthermore, the profit and loss statement can be an illustrative tool in performance measurement, as it can be broken down into various segments—product lines, departments, or geographical regions. This granularity allows businesses to pinpoint high-performing segments while identifying underperformers. A deeper analysis may lead to strategic reallocations of resources, optimizing the overall enterprise efficiency.

In conclusion, the profit and loss statement is not merely an accounting document; it is a powerful narrative woven together from the financial threads of revenue, costs, and expenses. This statement holds the potential to shift perspectives, sparking curiosity to explore deeper into the business’s operational fortitudes and frailties. Organizations must embrace this statement, not just as a reporting tool, but as an opportunity to glean insights, refine strategies, and ultimately drive sustainable growth. Such an approach will not only foster fiscal responsibility but also cultivate an environment primed for innovation and adaptability in an unpredictable economic landscape.