In the intricate tapestry of vehicle ownership, the phrase “insurance loss reported” serves as a daunting thread that can unravel the fabric of any prospective buyer’s peace of mind. This term might appear as a simple notation in a vehicle history report, yet it whispers tales of past misfortunes and hidden truths, urging an examination that extends beyond the superficial. To unpack this vital information, one must delve into the layers of what it signifies and how it influences the journey of owning a vehicle.

The concept of an insurance loss reported can be likened to a shadow cast over an otherwise pristine landscape. When an insurance company marks a vehicle with this designation, it indicates that the automobile has experienced a profound incident, typically leading to a claim that alters its narrative forever. Such incidents may encompass accidents that result in significant damages, theft, or even total losses where the vehicle is deemed irreparable. Each report embodies a story – one that reflects not just the vehicle’s past, but also echoes the broader implications for future ownership.

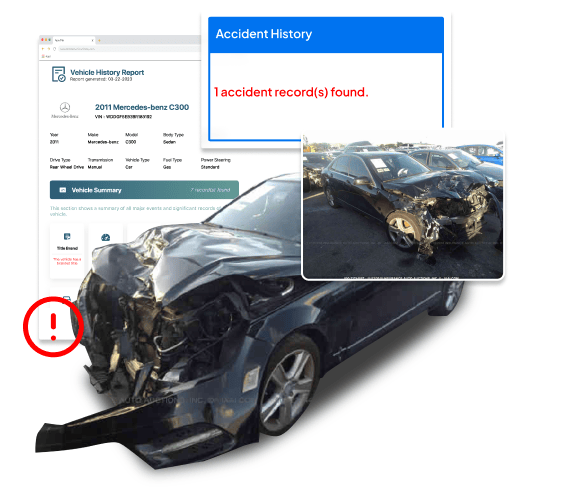

Understanding this term requires a fundamental grasp of vehicle history reports. These documents are akin to a vehicle’s autobiography, chronicling its life from the moment it rolled off the assembly line to its current state. When insurance companies engage this narrative, they are, in essence, commenting on the chapters that reveal red flags—concerning events that potential buyers should consider seriously.

When an insurance loss is reported, it usually signifies severe damage, either structural or mechanical, prompting the insurance agency to classify the vehicle as a total loss. This label does not merely communicate a one-time event; it establishes a continuum of declining value and potential safety concerns. Much like a piece of art marred by a bold brushstroke that disrupts its symmetry, the implications of an insurance loss are often far-reaching.

If the vehicle has endured a catastrophic incident leading to such a designation, other determinants of its viability emerge. After an insurance loss, the vehicle might have undergone repairs, but the durability of those repairs can be questionable. Factors like the quality of workmanship, the integrity of replacement parts, and the complexity of the damage all contribute to the lingering specter of uncertainty. Buyers should approach these vehicles with critical eyes, as the scars of past incidents may resurface.

Yet, it is not solely the condition of the vehicle that should concern potential owners; it is also the financial ramifications attached to such reports. A vehicle with an insurance loss often faces depreciation that can considerably outpace that of comparable models without such a history. When trying to sell, a vehicle with a recorded loss may linger on the market, unwanted and overlooked, linked by its past to lower resale values. The owner, therefore, not only inherits a car but also an ongoing narrative of fiscal disarray.

However, while the terminology may sound ominous, not all insurance loss reports should be viewed with unmitigated dread. There are instances where vehicles have rebounded from their past misfortunes. It is essential to note that meticulous proof of quality repairs and diligent maintenance can restore confidence and even esteem to an affected vehicle. In this case, the restoration serves as a testament to resilience, akin to a phoenix rising from the ashes, emerging to captivate future admirers once again.

The key to discerning the true implications of an insurance loss lies in the thorough examination of accompanying details: repair receipts, service records, and the results of any inspections conducted post-repair. Engaging a trusted mechanic to evaluate the vehicle further delineates the shadow cast by an insurance loss. Their expertise can unveil any lingering issues, granting potential owners the clarity they need to make informed decisions.

Moreover, the existence of an insurance loss report may provide buyers with leverage in negotiations. Understanding the landscape allows them to advocate for fairer pricing reflective of the vehicle’s true market value. This can turn what initially appears as a drawback into a strategic advantage, enabling savvy shoppers to capitalize during the acquisition process.

However, while the allure of a deal is captivating, it is paramount to discern when a vehicle’s history becomes a burden too great to bear. Some might find themselves enchanted by the prospects of owning a vehicle once overshadowed by tragedy. They must weigh this against the potential pitfalls that an insurance loss reports entail.

In essence, deciphering the meaning of “insurance loss reported” involves piecing together fragments of history, damage, and recovery. It invites vehicle owners and prospective buyers alike to reflect on the stories these machines hold, their previous tribulations, and how they may continue to impact the journey ahead. In this way, understanding the insurance loss report transforms not just the act of buying a car or managing a vehicle into a contemplative endeavor but also enriches the experience of driving through life’s wide-open roads with greater insight and awareness.

When it comes to vehicle history, knowledge is indeed power. With understanding comes discernment, and with discernment, the capability to make choices that are informed by more than just a superficial glance at the dealership. It is essential to embrace the past of any vehicle, as it is intricately woven with future experiences, ensuring that each drive is not just a commute, but an engaging journey enveloped in narrative and discovery.