When you encounter a bill with a negative amount, your initial reaction might be confusion or even disbelief. Such an occurrence can lead you to question the intricacies of billing systems and how they correlate to your financial standing. A negative amount on a bill doesn’t signify debt; instead, it often represents an intriguing shift in perspective regarding your consumption, payments, and the dynamics of utility services. Let’s delve into the implications of a negative bill, and unveil the myriad of reasons it might materialize.

Understanding the Mechanism Behind Negative Amounts

At first glance, a negative amount can evoke anxiety about miscalculations or errors; however, it is essential to recognize that it frequently indicates a credit on your account. This can occur in various scenarios, from overpayments to account adjustments. For instance, if you have paid more than what was due in a previous billing cycle, the excess may be credited toward your future bills. This advance payment often circumvents the burden of a hefty bill next month and provides a delightful reprieve from immediate financial obligations.

Credits from Utility Companies

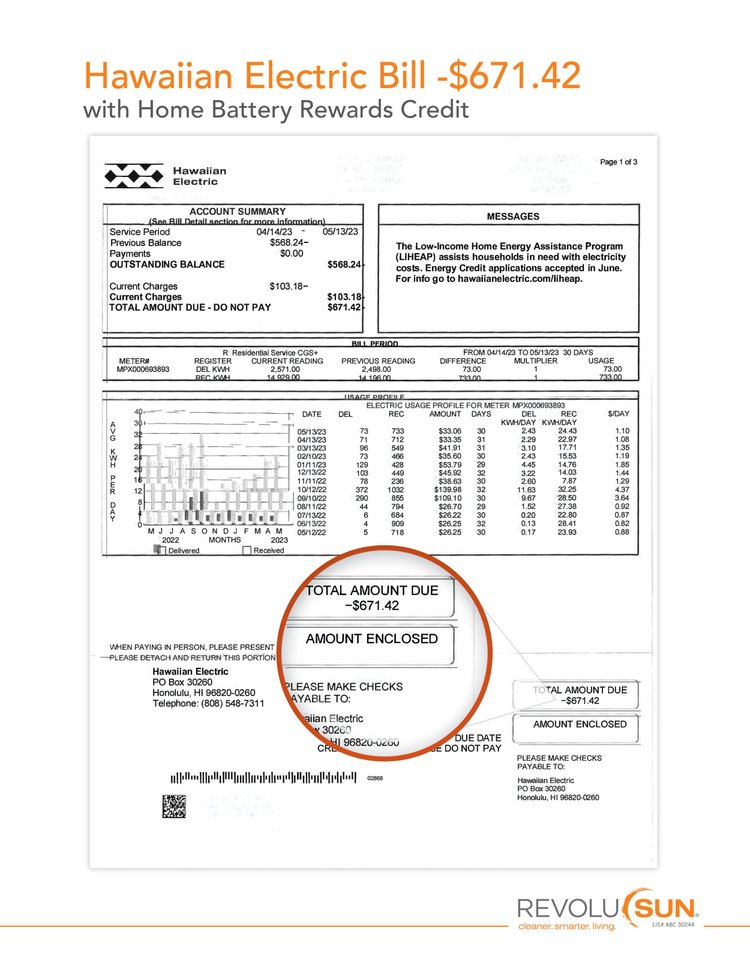

Utility companies, particularly those related to gas, water, or electricity, frequently issue negative bills due to excess payments or adjustments made to your account. In cases where you have solar panels installed, for example, a negative balance may represent the electricity your system has generated, surplus to your own consumption. This surplus can often be rolled over into credit, showcasing not only the potential for savings but also a more sustainable approach to energy consumption. These credits can transform how you view your energy dependency, nudging you towards a more proactive stance on conservation.

Other Causes of Negative Balances

Besides overpayments and renewable energy credits, there are various other factors that might lead to a negative bill. Promotions or discounts offered by service providers can reduce your balance when applied. For instance, many companies incentivize new customers with promotional rates that enhance the likelihood of encountering a negative amount soon after service initiation. It’s a clever tactic to draw new customers in while simultaneously increasing their sense of satisfaction and loyalty.

Furthermore, billing discrepancies may inadvertently lead to negative balances. If you notice a negative amount due to an error, it’s crucial to contact the provider promptly. Such an interaction can not only clarify your billing situation but may also foster a conversation about transparency and trust with your utility provider. It encourages a two-way dialogue that can cultivate better service in the long run.

Perceptions and Psychological Implications

The emergence of a negative bill can trigger a transformative perspective on financial management. Instead of viewing bills merely as debts to be settled, a negative balance can reframe them as opportunities for savings and planning. It showcases the importance of being vigilant about your energy consumption and financial habits. Understanding the rhythm of your consumption can empower you to make more informed decisions that elevate your financial health.

Moreover, a negative bill can serve as a gentle reminder of the benefits of proactive engagement with service providers. Encouraging dialogue about rates, discount eligibility, or changes in usage patterns can result in advantageous billing adjustments. This realization may instill a sense of agency within you, enabling a shift from passive acceptance of bills to a more assertive and engaged consumer relationship.

Implications for Budgeting and Financial Planning

For the savvy budgeter, encountering a negative bill can drastically alter financial planning approaches. When a negative figure surfaces, your strategy might shift from rigid expense tracking to more fluid financial management. The surplus funds represented in these negative amounts offer potential avenues for reinvestment or savings. Such strategic adjustments could take the form of allocating those funds toward paying down debts or investing in future energy savings, such as energy-efficient appliances.

This innovative approach to budgeting extends beyond mere financial allocation; it invites a broader mindset of sustainability. By recognizing the value in surplus credits, you can consciously seek to reduce wastage, effectively transforming your spending habits into an ally for both your financial wellness and ecological responsibility.

Conclusion

In conclusion, a negative amount on a bill beckons a deeper inquiry into your consumption habits, payment practices, and potential savings. The implications of such a balance are far-reaching and transformative, leading you to reconsider not only the nature of billing but also your relationship with utility providers. The emergence of this financial anomaly opens the door to empowerment, inviting you to adopt a more conscientious approach to both spending and resource conservation. Ultimately, a negative bill can serve as a bridge toward a more sustainable and financially astute future.