When an account is labeled as being “now with FMA,” it signifies a transformative juncture in the regulatory oversight of financial services and products. For both financial institutions and investors, this phrase carries implications that can stir curiosity and warrant a closer examination. The term “FMA” stands for the Financial Markets Authority, a pivotal entity that safeguards market integrity and bolsters investor protection in the realm of finance. Understanding what it means for an account to be under the purview of the FMA opens a Pandora’s box of insights into regulatory frameworks, compliance, and the overarching mission of market supervision.

To ascertain the significance of an account being “now with FMA,” it is essential first to comprehend the function and scope of the Financial Markets Authority. Established to regulate financial markets, the FMA oversees various sectors, including securities, financial advisers, and collective investment schemes. The agency’s mandate extends beyond mere compliance; it strives to instill confidence in the financial system and empower investors through transparency and accountability.

When an account transitions to being managed by the FMA, whether it is an investment fund, a trading platform, or a financial advisory service, it invokes a paradigm shift in how that account is supervised. This move signifies that the account is now subject to rigorous regulations that aim to protect investors. This newfound oversight often enhances the trustworthiness of the services or products associated with the account.

A pivotal concept to grasp in this context is regulatory compliance. Financial entities that fall under FMA’s jurisdiction are required to adhere to stringent laws and guidelines. These rules are designed to maintain an equitable trading environment, prevent malfeasance, and ensure robust disclosure practices. For example, investment advisors must provide clients with clear, comprehensive information about fees, risks, and investment strategies. This degree of transparency is pivotal in eliminating ambiguity and fostering informed decision-making among investors.

The implications of an account being under FMA oversight extend into risk management as well. The FMA plays a crucial role in identifying potential risks associated with financial products and services. This includes scrutinizing investment portfolios for excessive leverage, ensuring that derivatives are adequately hedged, or assessing the solvency of financial institutions. By implementing these safety nets, the FMA not only aims to protect individual investors but also strives to safeguard the stability of the overall financial system.

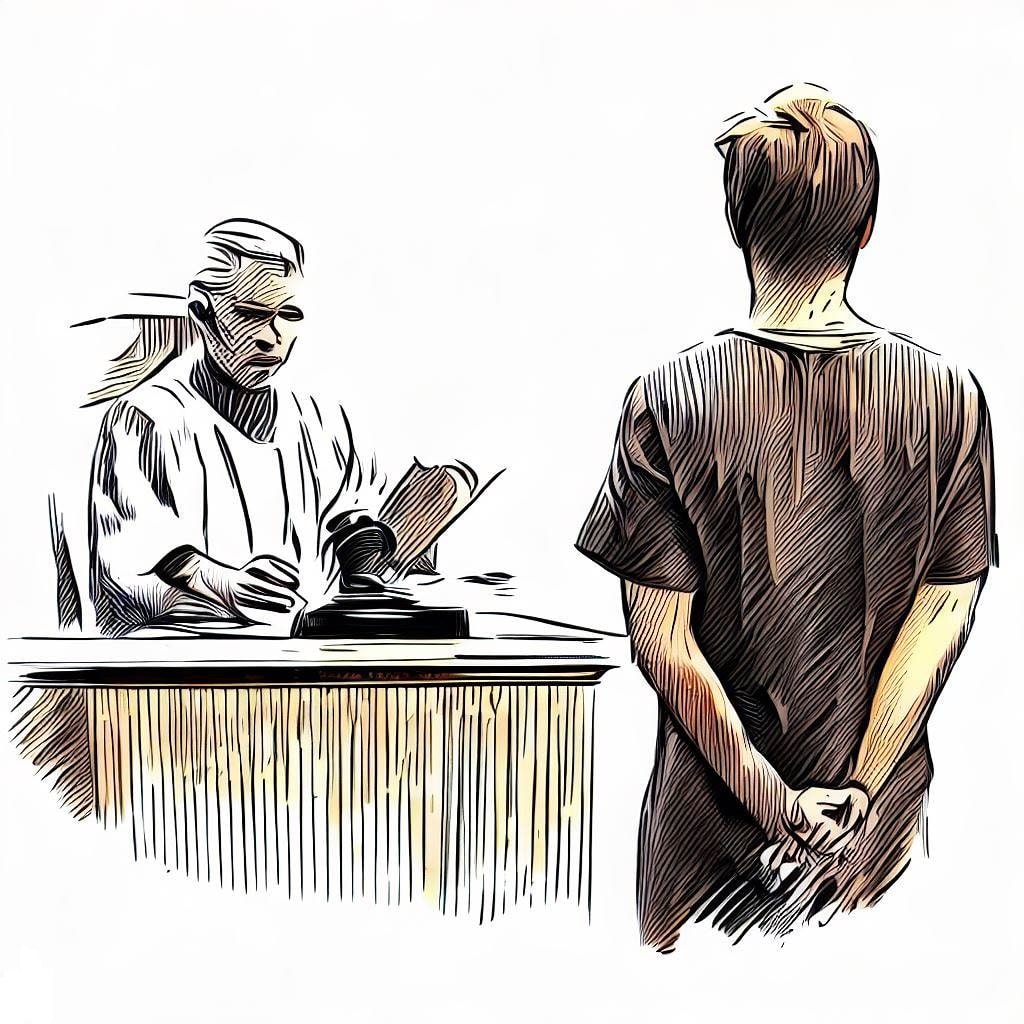

Moreover, the FMA is equipped to intervene in situations where malpractices or irregularities are detected. This intervention capacity is a significant deterrent against unethical behavior in the financial markets. Should an account be found violating regulations – such as engaging in insider trading, misrepresenting investment products, or committing fraud – the FMA possesses the authority to impose penalties, revoke licenses, or even initiate criminal proceedings. Thus, the stakes are high, and the accountability enforced by the FMA cultivates a culture of compliance among financial service providers.

For investors, an account being with FMA serves as a beacon of guidance. The authority publishes valuable information, including advisories and alerts that shed light on potentially hazardous investment schemes. Their website often features resources that illuminate the risks involved in different sectors, helping investors navigate the complexities of the financial landscape effectively. Knowledge truly is power, and operating within an FMA-regulated framework ensures that investors have access to the necessary tools and information to make prudent financial decisions.

Furthermore, the implications of being with FMA extend to customer recourse mechanisms. In instances where investors suffer losses due to mismanagement or regulatory violations, the FMA enables pathways for dispute resolution and restitution. This level of consumer protection is critical, as it reinforces the principle that investors should have avenues to seek redress should the integrity of their investments be compromised.

The evolution of an account’s status to being “now with FMA” may also lead to increased scrutiny by third-party observers, including financial analysts, researchers, and potential investors. This heightened attention can offer new opportunities for growth and enhancement within the financial product offerings associated with that account. When an account is integrated into the FMA framework, it may also be viewed as more attractive to risk-averse investors seeking security and regulatory adherence.

In addition to all the regulatory and compliance contexts, the psychological impact should not be overlooked. Market participants often perceive an account with FMA oversight as more reliable. This perception can lead to increased investor confidence and participation, thus potentially inflating the value and legitimacy of the account itself. When investors feel secure in their dealings with a regulated entity, they are more inclined to engage, which, in turn, drives demand and business growth.

To encapsulate, the phrase “now with FMA” reflects more than mere regulatory compliance; it embodies a commitment to transparency, consumer protection, and market integrity. The Financial Markets Authority acts as a guardian of ethical practices while providing a framework within which financial institutions must operate. As a direct consequence, both financial services and investors enjoy enhanced security and a clearer understanding of their rights and responsibilities. In an ever-evolving financial landscape fraught with uncertainty, being within the FMA’s regulatory reach promises a noteworthy shift in perspective – one that emphasizes safety, trust, and informed decision-making.