What does cash surety really mean? This phrase often sparks curiosity, especially among those unacquainted with legalese. For many, it evokes images of courtroom drama or the clattering of coins in a law office. But beneath its surface lies a concept that intertwines law and finance in a remarkably intricate manner. Let us delve into the nuances of cash surety, exploring its definitions, applications, and implications for both legal and financial realms.

The Essence of Cash Surety

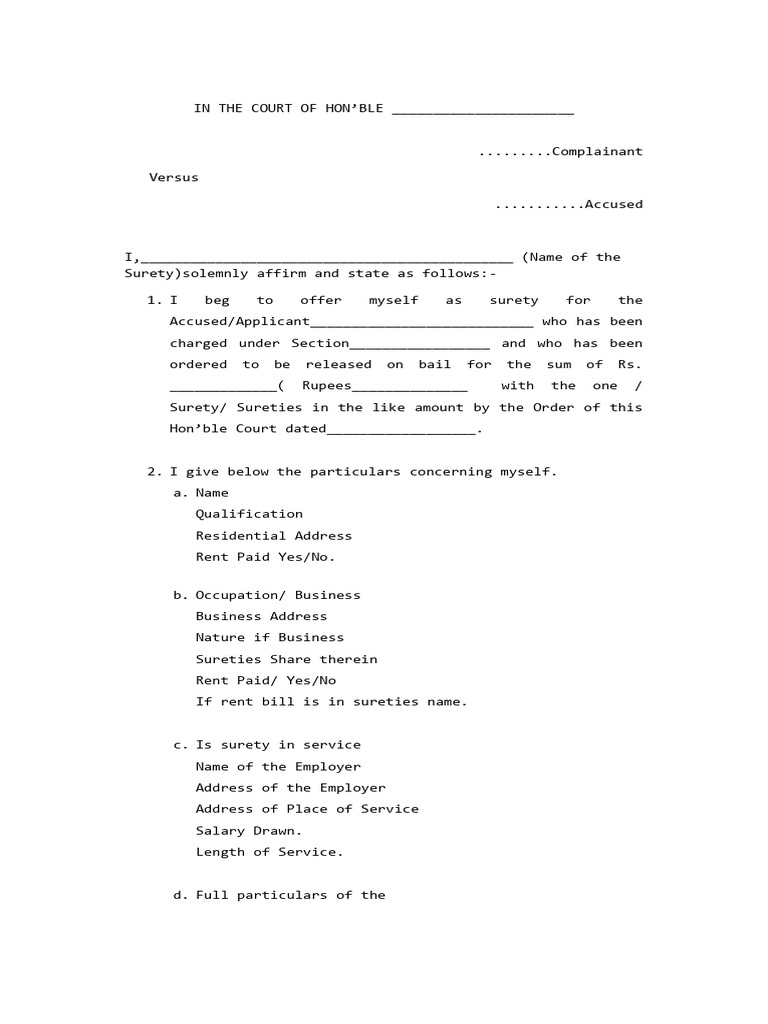

At its core, cash surety represents a financial guarantee, typically required in legal proceedings or contractual agreements. It serves as a form of collateral or security deposit that assures the fulfillment of an obligation. In many cases, cash surety is essential for securing bail, where a defendant provides a monetary amount to the court to ensure their appearance at future hearings. Should the individual fail to appear, the court retains the cash as a penalty.

Understanding the Legal Framework

The legal implications of cash surety are profound. Within the context of criminal law, a cash surety bond is often seen as a mechanism to balance the scales of justice. By allowing defendants the opportunity to post bail through cash, the system acknowledges the principle of presumed innocence. Nevertheless, navigating the labyrinth of regulations concerning cash surety necessitates a keen understanding of local laws, as these can vary significantly by jurisdiction.

Consider this: what happens if an individual lacks the necessary cash to secure their release? This quandary opens up a broader conversation surrounding societal inequality and the justice system. The inability to afford bail can result in pre-trial detention, disproportionately affecting marginalized communities. This stark reality underscores the importance of reform in bail practices—where cash surety is both a lifeline and a potential pitfall.

Types and Mechanisms of Cash Surety

The landscape of cash surety is not monolithic; it encompasses several types and mechanisms. For instance, individuals may opt for a cash surety bond, which involves depositing the full bail amount with the court. Conversely, some jurisdictions permit a surety bond, where a third party, like a bail bondsman, vouches for the defendant in exchange for a fee. This distinction is critical, as it speaks to the financial resources available to the accused and influences their legal strategy.

Moreover, cash surety isn’t limited to criminal cases. It also appears in civil litigation. In disputes concerning contracts, landlords might require cash surety to safeguard against potential losses from tenants. This further illustrates the versatility of cash surety, showcasing how it permeates numerous sectors beyond the courtroom.

Financial Implications: Risk vs. Reward

From a financial standpoint, cash surety embodies both risk and reward. Consider the risk—when individuals or corporations place a significant amount of money as cash surety, they face the possibility of forfeiture. If they default on their obligations, their cash becomes a lost investment. This potential for loss weighs heavily on decision-makers, leading them to meticulously analyze their risk-benefit scenarios.

Yet, the rewards can be substantial. For financial institutions, cash surety can ease the process of recovering loans or investments. It acts as a safety net, bolstering the institution’s security during turbulent economic times. This duality of cash surety compels entities to tread carefully, weighing their commitments against their available capital.

Alternatives to Cash Surety

There are also emerging trends in the realm of cash surety, particularly with technology’s increasing influence on the legal landscape. Online platforms are now facilitating surety agreements through digital currencies, reshaping how individuals engage with cash surety. These innovations pose intriguing questions: Will traditional cash surety become obsolete? Can technology democratize access to legal and financial resources previously limited to the affluent?

Navigating Challenges and Complexities

With all its bearing, cash surety also comes laden with challenges. The complexities of understanding where, how, and when to utilize cash surety can bewilder even seasoned professionals. Many individuals fail to comprehend the intricacies of forfeiture laws, resulting in unexpected financial losses. Moreover, the burden of understanding cash surety often falls disproportionately on those lacking legal literacy.

This suggests a compelling need for educational outreach on financial commitments and legal rights. Knowledge is, indeed, power. Arming individuals with the tools necessary to navigate this labyrinth can foster a justice system that is both equitable and efficient.

Conclusion: A Reflection on Cash Surety

In conclusion, cash surety is not merely a financial instrument but a societal challenge that intertwines legal principles with profound socio-economic implications. It serves as a bridge between individuals and the justice system, yet its inherent complexities and risks often leave many navigating in murky waters. Engaging with this topic, one cannot help but ponder: How can we ensure that the scales of justice balance fairly for all, regardless of financial means? Addressing cash surety calls for collective reflection, innovation, and reform, making it a critical discourse in both the legal and financial spheres today.