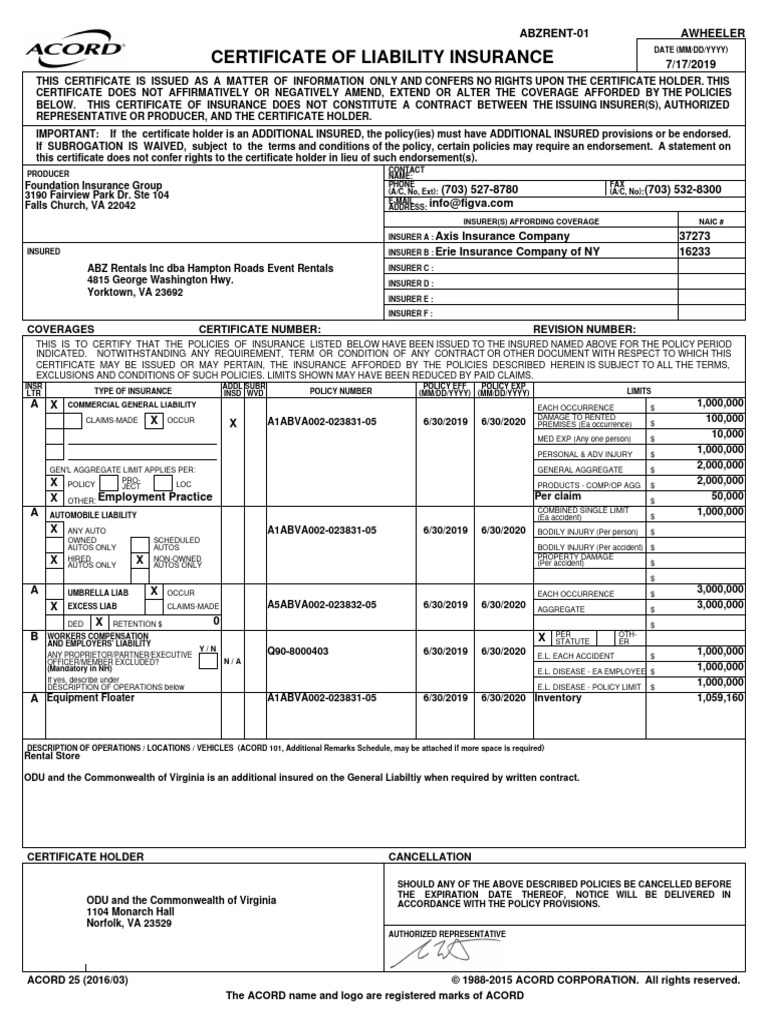

In the labyrinth of individual financial planning, the Certificate of Insurance (COI) emerges as a pivotal instrument, often underappreciated. This document serves not just as proof of insurance, but as a beacon, illuminating the myriad liabilities an individual may face. In financial parlance, a COI is akin to a compass, guiding individuals through the terrain of risk management. Let us delve into this topic with nuance and clarity, exploring the intricacies of a COI through the lens of individual financial management.

The essence of a COI lies in its promise of protection. For individuals, this protection manifests in various forms, from liability insurance to property coverage. Each policy is meticulously tailored, representing a unique synthesis of personal risk exposure and financial acumen. But what does a COI signify in practical terms? It encapsulates assurances, delineating the parameters of coverage while serving as an essential document in the pursuit of financial safety.

Imagine a freelancer, diligently carving out a niche in the competitive landscape of freelance design. The nature of their work exposes them to substantial liability risks. Let’s say they are accused of infringing on copyright provisions while executing a project for a client. Without a robust COI, the financial repercussions could prove catastrophic. The COI verifies that their liability insurance covers such incidents, thereby providing a crucial safety net.

However, the utility of a COI transcends mere protection; it can radically shift one’s perspective on risk. Consider the case of an individual who has recently embarked on homeownership. The world of property ownership is riddled with uncertainties—a tree falls on a neighbor’s fence, or perhaps a guest slips and falls on an icy walkway. With a comprehensive COI that includes general liability coverage, a homeowner can navigate these scenarios with confidence. The mere possession of such a document transforms their outlook, bridging the chasm between fear and reassurance.

A meticulously structured COI also contains critical artifacts that can bolster the individual’s financial portfolio. It delineates the coverage amounts, the insured events, and the beneficiaries. For those engaged in business activities, a well-articulated COI can enhance credibility with potential clients and partners. Clients are often inclined to engage with professionals who can substantiate their financial resilience through a valid COI. Such assurances cultivate trust and foster longer-term relationships grounded in stability.

Diving deeper, a COI also encapsulates the nuances of contractual obligations. It delineates the boundaries of liability and outlines the rights of the insured and the insurer. By laying bare these intricate details, it empowers individuals to make astute financial decisions. For instance, when entering into contracts, understanding the specifics of what is covered under a COI can allow an individual to negotiate better terms, minimizing their exposure to unforeseen liabilities. This level of comprehension often ignites curiosity about the broader implications of insurance in one’s life.

Moreover, the confluence of innovation and insurance has birthed new opportunities for individuals. By leveraging technology, insurers now provide more personalized and agile COI options. This means that individuals can have tailored coverages that resonate with their unique lifestyles and professional choices. Embracing such advancements not only ensures protection but also invites a transformative approach to financial planning. Individuals are now poised to explore how adaptive policies can align with their evolving needs.

Furthermore, financial literacy is paramount when embracing the importance of a COI. Individuals must be equipped with the knowledge to decipher complex insurance jargon. Engaging with terms such as “deductibles,” “exclusions,” and “premiums” can empower them to maximize the benefits of their policies. Financial seminars and workshops, alongside self-education through credible sources, can bolster one’s understanding of the insurance landscape. This proactive approach transforms a COI from a mere document into a strategic ally in one’s financial journey.

In a broader societal context, the ramifications of understanding and utilizing a COI can redefine individual security. As communities become increasingly interconnected, the collective financial responsibility can lead to enhanced safety nets. By ensuring that individuals are well-insured, the socio-economic fabric of society strengthens. This synergy underscores the significance of knowledge-sharing and collaboration in achieving shared prosperity.

Ultimately, a COI is not merely a regulatory formality; it is a testament to one’s commitment to safeguarding their future. It embodies the delicate balance between risk and security in personal finance. When individuals duly recognize the intricate web of liability woven into their lives, they not only arm themselves with protection but also cultivate a mindset ripe for growth and opportunity. As we navigate the complexities of financial management, the humble COI stands as a potent reminder of the strength found in preparedness and the peace of mind that comes with informed decision-making.

In conclusion, the journey through the intricacies of an individual financial Certificate of Insurance reveals profound insights. From offering protection and fostering credibility to cultivating financial literacy and enhancing community resilience, the multifaceted role of a COI invites individuals to rethink their relationship with risk. It is a catalyst for transformation, urging all to explore the rich tapestry of possibilities that lie beyond the mere document—a Financial COI is indeed an indispensable ally in the odyssey of life.