In the realm of financial reporting, the balance sheet stands as an essential document that provides a snapshot of a company’s financial position at a given point in time. Often referred to as the statement of financial position, this report is pivotal for stakeholders seeking to gauge the organization’s health. But what does a balance sheet truly encompass, and how does its structure provide insight into a company’s operations? Let us delve into the multifaceted aspects of this crucial financial statement.

A balance sheet is traditionally divided into three primary sections: assets, liabilities, and equity. This fundamental framework adheres to the accounting equation: Assets = Liabilities + Equity. Each component plays a distinctive role, illuminating different facets of a business’s financial landscape.

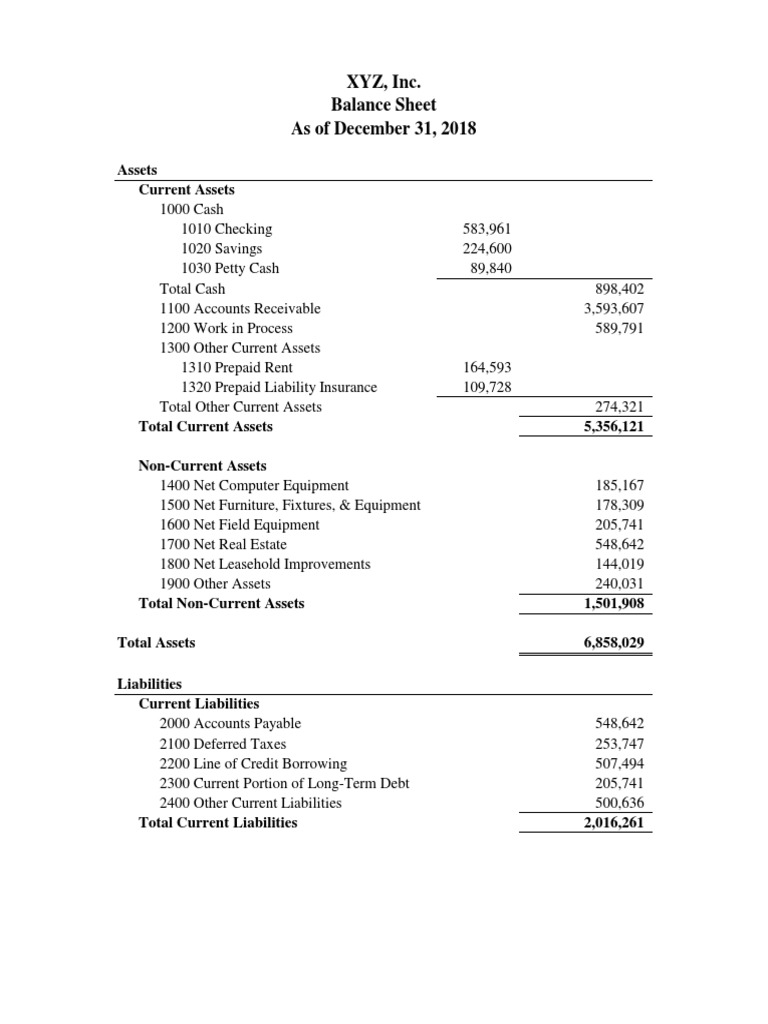

Let us begin with assets, which form the backbone of the balance sheet. Assets are resources owned by the company that are anticipated to yield future economic benefits. They can be categorized into current and non-current assets. Current assets include cash and cash equivalents, accounts receivable, inventory, and other resources expected to be converted into cash within a year. For instance, if a company has a notable inventory surplus, this might indicate a strategic decision to ramp up production or potentially point to declining sales.

Non-current assets, on the other hand, encompass long-term investments such as property, plant and equipment (PP&E), intangible assets like patents and trademarks, and long-term securities. These assets are not intended for immediate conversion into cash and demonstrate the company’s long-term financial strategy. For a manufacturing firm, heavy investments in machinery might underscore commitment to expansive production capabilities, reflecting on its operational strategy.

Transitioning to the second major component, liabilities represent the company’s financial obligations—amounts owed to creditors. Similar to assets, liabilities are also divided into current and non-current. Current liabilities include accounts payable, short-term loans, and other obligations due within one year. High levels of current liabilities relative to current assets can elicit concerns regarding liquidity, signaling potential cash flow challenges.

Non-current liabilities, encompassing long-term debt, deferred tax liabilities, and pension obligations, illustrate the company’s long-term financial commitments. A firm with significant non-current liabilities may suggest aggressive growth strategies financed through debt capital. However, such leverage can also elevate risk, especially if not managed judiciously.

Next comes equity, a fundamental section that encapsulates the ownership interest in the business. Equity comprises the funds invested by the owners, retained earnings, and any additional paid-in capital. Retained earnings, a pivotal aspect, denote the cumulative profits that have been reinvested in the business rather than distributed as dividends. This figure can reflect the company’s growth strategy; a high retained earnings balance may indicate a focus on reinvestment for future expansion rather than returning profits to shareholders.

The interplay between assets, liabilities, and equity is critical. Observing how these components evolve over time allows stakeholders to interpret financial health accurately. A well-structured balance sheet provides essential insights into the company’s operational decisions and financial strategy. For instance, a balance sheet with a high debt-to-equity ratio may indicate a risky approach to financing, whereas a lower ratio might reveal a more conservative posture towards leveraging and investments.

Furthermore, the balance sheet serves as a reflective tool. A company can employ comparative analysis by examining balance sheets over multiple periods. This practice unveils trends and trajectories—a rising inventory level, for instance, can prompt questions about future sales forecasts and inventory management efficiencies.

Reading and interpreting a balance sheet requires a discerning eye, capable of synthesizing data into actionable insights. Stakeholders—be they investors, creditors, or management—must consider ratios derived from the balance sheet, such as the current ratio, quick ratio, and debt-to-equity ratio, to evaluate liquidity, operational efficiency, and financial stability. Each ratio paints a different facet of the company’s financial health, facilitating informed decision-making.

In practice, balance sheets are not standalone documents; they integrate seamlessly with the income statement and cash flow statement. Collectively, these financial statements form the foundation of comprehensive financial analysis. For instance, trends in net income shown in the income statement paired with corresponding changes in retained earnings on the balance sheet depict a holistic view of profitability and growth.

To illustrate this concept, consider a hypothetical balance sheet of a growing tech startup. Suppose in 2022, the company showcases substantial cash reserves and minimal liabilities, signaling a robust financial footing. However, in 2023, the company opts for aggressive expansion, significantly increasing its debt to finance new projects. While the balance sheet may show escalating liabilities, the accompanying income statement might reflect rising revenues. Stakeholders would need to weigh these dynamics carefully, understanding that strategic expansion, while riskier, may lead to long-term gains.

Ultimately, the balance sheet serves as more than just a financial report; it embodies the strategic choices, operational realities, and future potential of a company. By analyzing its components systematically, stakeholders can glean insights that transcend mere numbers, fostering a deeper understanding of the business’s efficacy and prospects. A grasp of how to read and interpret balance sheets is essential for anyone engaged in the landscape of finance, enabling informed decisions that can steer enterprises toward enlightened growth and sustainability.