Checks, despite the digitalization of financial transactions, retain an intriguing position in personal finance. They possess an almost nostalgic quality, harkening back to an era where tangible currency and handwritten notes dominated exchanges. A filled-out check serves not just as a financial instrument, but also as a testament to personal responsibility, trust, and the formality of transactions. This article delves into the anatomy of a filled-out check, illustrating why this commonplace item evokes curiosity and fascination.

At first glance, a check may appear merely functional, yet its intricacies tell a compelling story. When viewed under the microscope, the typical check has several critical components, each designed to deliver clarity and security. The primary elements include the name of the issuing bank, the account holder’s information, the payee’s details, the amount to be paid, and, of course, the signature of the account holder. Each of these elements plays a significant role in ensuring that the check can be processed accurately and securely.

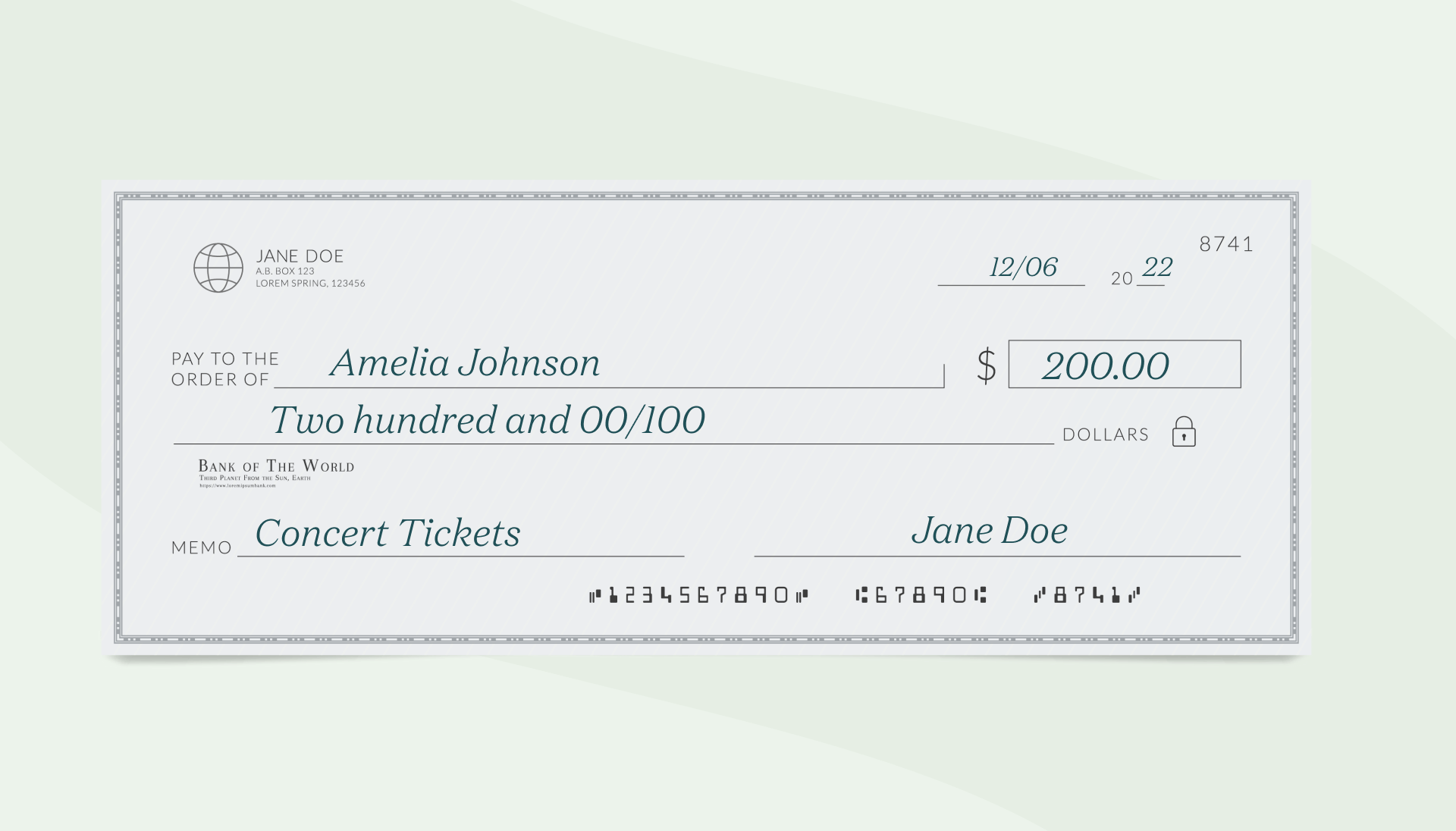

Let’s begin with the sender’s address. The account holder’s information is critical. It usually appears in the upper left corner and comprises their name, address, and sometimes phone number. This detail is not merely bureaucratic; it offers a personal touch. In an age when impersonal digital transactions reign supreme, the handwritten address serves as a reminder of individuality and personal connection. It provides context; each address carries its history, encapsulating stories of who we are and where we come from.

Next comes the date, typically found near the top right of the check. The date serves an essential purpose: it signifies when the transaction is legitimate. It’s the first marker of timeliness, evoking a sense of urgency or relevance. One could muse on how the passage of time—captured in ink—can influence relationships, contracts, and obligations. For all its simplicity, that small numeral bifurcates the future from the present, binding both parties to a temporal agreement.

Progressing downwards, we arrive at the famously designated payee line. It specifies the recipient of the funds. This line can sometimes be a source of intrigue. Who is getting paid? What is the nature of the transaction? Whether it’s a local business, a utility company, or a friend for dinner, the payee brings context to the check’s purpose. Speculating about each transaction reveals an intertwining web of relationships, reflecting how interconnected our lives are.

The amount of money to be paid appears in two crucial formats: both numerical and written out. This redundancy serves a utilitarian purpose—to minimize the risk of ambiguity. An amount written only in digits could lead to misunderstandings, and so the script ensures clarity. But beyond functionality, this dual representation might evoke a sense of caution and thoughtfulness; it deliberates the importance of each transaction and respect for the value of money exchanged.

The memo line, located at the bottom left of the check, serves as an often-underused space to communicate additional information about the purpose of the transaction. Here, one is encouraged to write brief notes, whether for household bills, gifts, or charity donations. This small area can be a treasure trove of insights into the nuances of personal finance. Here, the story continues to unfold. The casual observer might overlook these details, but for the writer, they encapsulate intentions, motivations, and the emotional context surrounding each exchange.

Finally, the signature line at the bottom right corner solidifies the check’s legitimacy. It is here that one bestows the seal of approval upon the document, affirming accountability and intent. Every signature tells a story of its own; it could evoke memories, represent a fleeting decision, or seal an agreement that impacts both parties involved. This small act is profoundly significant and profoundly personal.

The act of writing and delivering a check often touches on deeper underlying themes surrounding trust, obligation, and social contract theory. In a world where transactions can occur with just a button press, the manual filling out of a check invokes a sense of traditionalism. The tactile sensation of crafting a financial document connects us to generations of individuals who navigated similar transactions. Each check passed from hand to hand carries not only monetary value but also shared human experience. The respectful act of sending a check embodies values of consideration and deliberation.

As technology continues to evolve, the relevance of checks may wane, yet their symbolism holds steadfast. In times of turmoil or uncertainty, the check represents stability—a reassuring relic that transcends time. It prompts questions around value and trust in a fast-paced world. Even the mere act of filling out a check becomes an exercise in mindfulness, urging the individual to be intentional and aware of their financial standing and commitments.

In conclusion, a filled-out check is far more than just a medium for transferring funds. It encapsulates a tapestry of human interaction, thoughtfulness, and the art of formalizing agreements. Each check tells a story, from the elegant curves of the handwriting to the weight of the signature, reflecting our individual journeys and our interconnected lives. Even amidst the rise of digital payments, the check remains a captivating artifact—imbued with history and personal connection—serving as a gentle reminder of our shared experiences in the realm of finance.