Imagine for a moment that you just received your latest paycheck. As you eagerly open the envelope or login to your online payroll portal, you encounter a document known as a pay stub. But, what is this seemingly mundane piece of paper? Can it really hold the keys to understanding your financial well-being? In today’s world, the pay stub serves as an essential artifact in the relationship between employee and employer, shedding light on earnings, deductions, and ultimately, your economic standing. However, what if the details on that pay stub sparked more confusion than clarity?

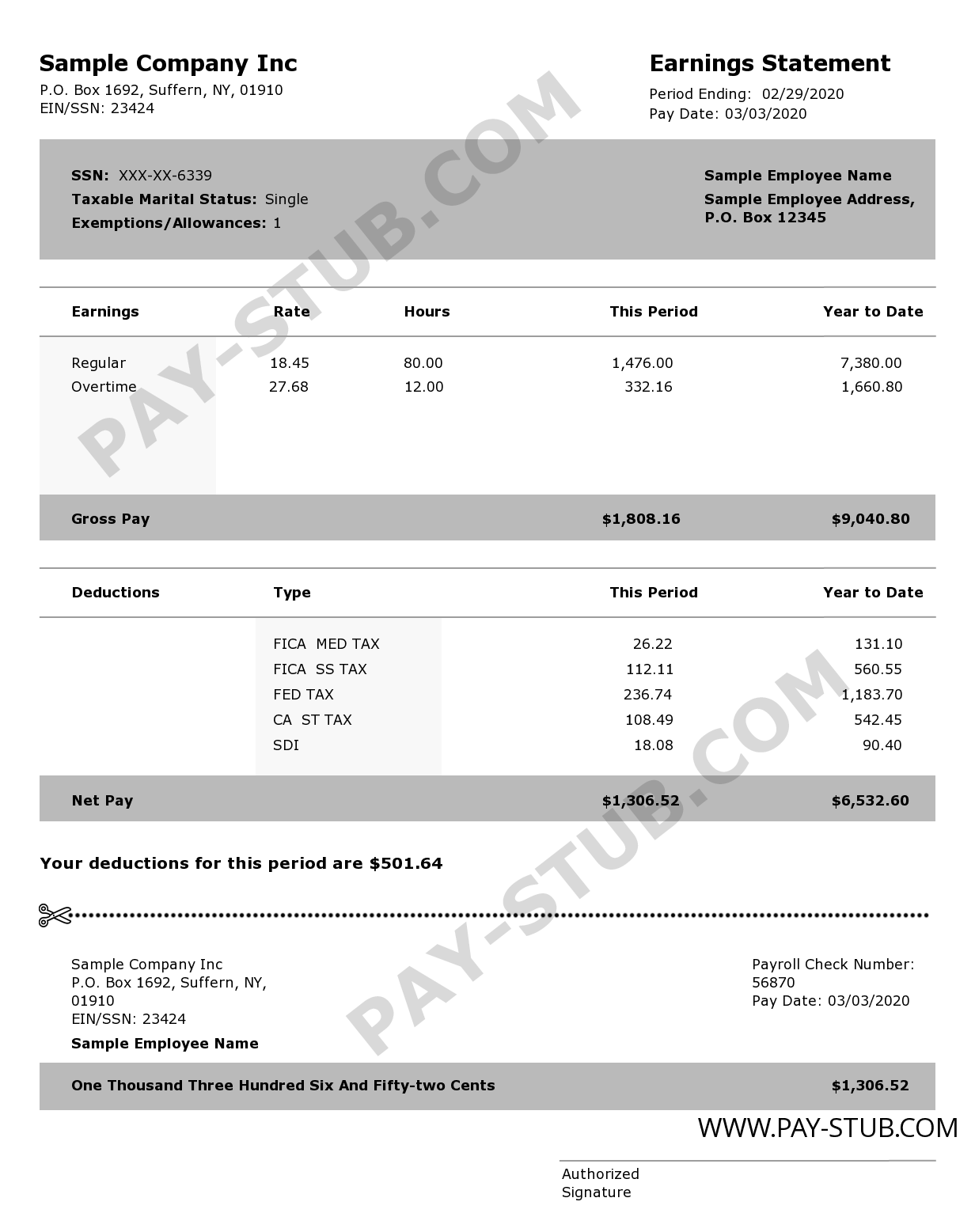

To unravel the intricacies of a pay stub, it is imperative to begin with its fundamental components. A typical pay stub serves as a ledger, meticulously detailing your earnings for a specified pay period. This document typically unfolds in a structured format, delineating crucial sections that encapsulate everything from gross pay to deductions. Let’s explore these segments one by one, illuminating their significance along the way.

1. Gross Pay: The Allure of Earnings

At the forefront of any pay stub is gross pay—the sum of money you have earned before any deductions are taken. This figure can include base salary, overtime, bonuses, and commissions. For instance, suppose you worked 80 hours at a rate of $20 per hour, your gross pay would amount to $1,600. Yet, this figure can swiftly become deceptive; it might seem like a sizable amount, but as we’ll discuss later, deductions will carve away at this handsome figure. The understanding of gross pay is essential; it is not merely a number, but a reflection of your labor value over a defined period.

2. Deductions: The Unseen Forces

Once you’ve gawked at your gross pay, you may be met with an array of deductions. These reductions can be mandated by law, such as federal and state taxes, or they may arise from voluntary contributions, such as health insurance premiums or retirement fund allocations. Each deduction has its own narrative. For example, FICA taxes, which fund Social Security and Medicare, follow you throughout your working life, promising coverage during your golden years.

Now, consider the challenge these deductions pose. Have you ever looked at your pay stub and pondered why so much is being deducted? How do you make sense of the difference between your gross pay and net pay? It is paramount to scrutinize every line item, as understanding these deductions not only provides transparency but empowers you to make informed financial decisions.

3. Net Pay: The Take-Home Value

After the deductions have taken their toll, you reach the end of the pay stub trail: net pay. This is the coveted figure, the amount that actually lands in your bank account, ready for you to allocate toward your monthly expenses. It’s excellent to know your gross pay, extravagant to dream with it, but ultimately, it’s the net pay that governs your day-to-day financial reality. The gap between gross and net can be eye-opening. And therein lies the potential challenge: are you managing your finances based on your gross income, or have you factored in those relentless deductions?

4. Year-to-Date Totals: Trends and Trajectories

As you scrutinize your pay stub, do not overlook the year-to-date (YTD) totals. These figures accumulate throughout the year, providing insights into your earnings and deductions on a grander scale. Observing YTD totals enables you to visualize your financial trajectory. Are you on track to meet your savings goals? Are you contributing adequately to your retirement fund? The YTD section is a treasure trove of information that prompts self-evaluation and forward thinking.

5. Additional Considerations: Beyond the Basics

While grasping the fundamental components of a pay stub is invaluable, there are additional considerations that merit attention. Many employers utilize direct deposit for payroll, which propels convenience but makes reviewing pay stubs online essential. A digital platform often displays pay stubs with added features—accessible accounting tools and breakdowns may assist in contextualizing your financial health.

Furthermore, it is prudent to be aware of alternating pay schedules, which can impact your financial planning. Are you paid bi-weekly, semi-monthly, or perhaps on a commission basis? Understanding the frequency of your payments is crucial as it affects budgeting. Have you ever considered how this rhythm of payday alters your approach to savings or expenditures?

6. Tips for Navigating Your Pay Stub

Now that we’ve unraveled the layers of a pay stub, how can you utilize this knowledge to enhance your financial literacy? Start by regularly reviewing your pay stub—what emerges as the simplest endeavor can often elude many. Collaborate with a financial advisor to dissect your document if you feel uncertain. Tracking changes over time can also illuminate trends in your income or deductions that demand your attention.

Additionally, consider utilizing tools such as budgeting apps, which may aid in matching your pay stub to your actual spending, facilitating smarter financial choices. Finally, consulting with your employer’s HR department can provide clarity on unfamiliar deductions or pay structures that may perplex you.

In conclusion, a pay stub is more than merely a sheet of paper lying on your desk. It is an educational document that can empower you in your financial journey. So the next time you hold your pay stub, take a moment to appreciate the intricate details within it. Will you take on the challenge of deciphering it in full? With diligence and curiosity, you can transform that confusion into understanding, mastering your financial narrative one pay stub at a time.