Understanding the concept of a Tax Identification Number (Tax ID) is paramount for individuals, businesses, and organizations alike. These alphanumeric codes serve as unique identifiers for tax purposes, functioning like an individual’s Social Security number but on a broader scale. They help streamline the tax process and are vital for compliance with the law. This article explores various examples of Tax IDs, unraveling their purpose, types, and significant implications in the financial landscape.

At its core, a Tax ID assists taxing authorities in tracking tax obligations and ensuring that all entities contribute their fair share to the national revenue. Taxpayers, both individuals and corporations, must understand not only how these identifiers work but also how they apply in different contexts. Let’s delve into the various forms of Tax IDs, illuminating the intricacies that accompany each.

1. Social Security Number (SSN)

For many Americans, the most familiar Tax ID is the Social Security Number (SSN). This nine-digit number is crucial for taxpayers, particularly individuals. Primarily, it serves as a means of tracking wages and benefits within the Social Security system. Beyond this, an SSN is required when filing tax returns, applying for government benefits, or engaging in financial transactions.

The SSN is unique to each individual, not transferable, and is used extensively to confirm identity. Hence, safeguarding it is critical, as identity theft remains a prevalent concern in today’s digital age.

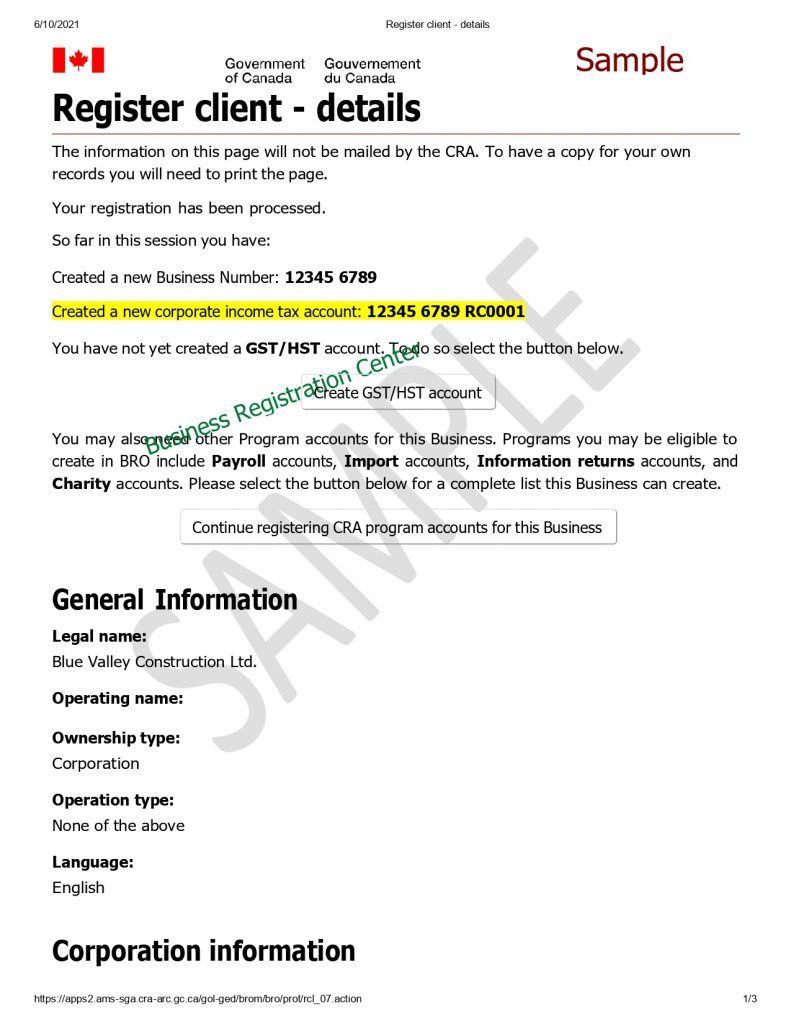

2. Employer Identification Number (EIN)

Moving beyond individual taxation, we encounter the Employer Identification Number (EIN). This 9-digit number, sometimes referred to as a Federal Tax Identification Number, is primarily used by businesses. The IRS issues EINs to identify business entities, facilitating tax reporting and payroll administration. Any business entity, from sole proprietorships to corporations, can utilize an EIN, underscoring its versatility.

An EIN is necessary for establishing business bank accounts, applying for loans, and assembling a comprehensive tax return. Moreover, it aids in segregating personal and business finances, a prudent practice that can protect individual assets.

3. Individual Taxpayer Identification Number (ITIN)

For individuals who are not eligible for an SSN, the Individual Taxpayer Identification Number (ITIN) emerges as an essential tool. Designed for non-resident aliens, their spouses, and dependents, the ITIN enables these individuals to comply with U.S. tax laws. Unlike the SSN, ITIN is not used for work authorization but rather to facilitate tax filings.

ITINs are particularly beneficial for those who need to report income to the IRS but do not have a Social Security number. However, it’s crucial to note that the ITIN cannot serve as a means for obtaining legal immigration status.

4. Preparer Tax Identification Number (PTIN)

Tax professionals and preparers utilize the Preparer Tax Identification Number (PTIN) to file tax returns on behalf of clients. This unique identifier signifies that the individual is officially registered with the IRS as a tax preparer. For taxpayers, hiring a professional with a PTIN ensures a level of credibility and adherence to regulations, as preparers are required to renew their PTIN annually.

The implications of using a PTIN extend beyond mere paperwork; it speaks to the quality of tax preparation services available in the market.

5. C-Corporation and S-Corporation Identification Numbers

Corporations operating within the U.S. also navigate unique Tax IDs based on their structure. C-Corporations and S-Corporations each have specialized identification numbers issued by the IRS. While functions are similar to the EIN, the distinction lies in their tax implications.

C-Corporations are subject to double taxation, being taxed at both corporate and individual levels on dividends. Conversely, S-Corporations are structured to avoid double taxation, allowing income to flow directly to shareholders, who then report it on their individual tax returns. Consequently, the classification and corresponding Tax ID can significantly impact a corporation’s financial obligations.

6. State Tax Identification Numbers

On a more localized level, businesses may also need state tax identification numbers, often mandated for state tax compliance. These numbers are issued by state tax authorities and are necessary for businesses engaging in operations within state jurisdictions. Depending on the state, these identifiers may differ in format or application, adding complexity to the regulatory framework that businesses must navigate.

This state-based taxation system often intersects with federal laws, creating layers of tax obligations that must be thoroughly understood to maintain compliance.

Conclusion

In summary, Tax Identification Numbers are a fundamental aspect of the tax system, encompassing various forms, each designed for specific purposes and entities. From individual taxpayers who rely on their SSNs to businesses that need EINs and state identifiers, understanding these tax IDs is vital for effective tax management and compliance. As the tax landscape continuously evolves, being informed about the different types of Tax IDs will empower taxpayers to navigate their financial responsibilities with confidence and clarity.