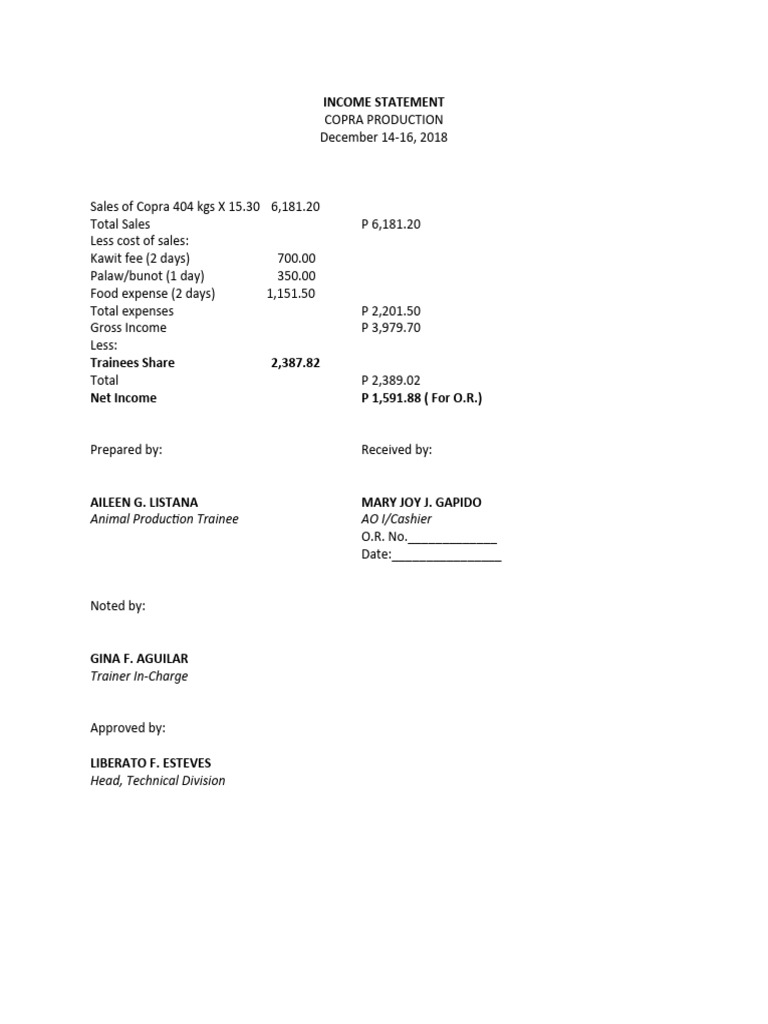

In the realm of financial dominions, the income statement stands as a beacon, illuminating the fiscal fortunes and tribulations of a business over a specified timeline. Often likened to a well-composed symphony, it harmonizes revenues, expenses, and net income into a melodious account of performance. Each line item within its structure serves a unique instrument, contributing to the overall crescendo of financial storytelling.

At its essence, the income statement reveals the vitality of an enterprise, encapsulating its ability to generate wealth and sustain operations. The composition unfolds in a sequenced manner, presenting crucial figures that delineate financial health. Understanding the components is akin to discerning the notes of a complex musical score, each playing a vital role in creating the complete financial narrative.

The Prelude: Revenue Recognition

Every great composition begins with a gripping prelude, and in the income statement, this is unmistakably revenue. Revenue is the lifeblood of an organization, akin to the sun that nourishes the plants in a vast garden. It represents the cumulative sales of goods and services rendered, providing insight into the effectiveness of the company’s core operations. This section can further be broken down into categories such as gross revenue and net revenue, where deductions for returns, allowances, and discounts are made, painting a clearer picture of actual financial inflow.

Analyzing revenue trends can be likened to observing the changing seasons. Much like the growth of trees in spring, a blossoming revenue figure reflects robust business strategies and market demand. Conversely, wilted revenue can signal market inefficiencies or shifting consumer preferences, urging business leaders to recalibrate their approaches.

The Interlude: Operational Expenses

As the symphony progresses, we encounter operational expenses, the interlude that contrasts the glory of revenue. This section delves into the costs associated with maintaining and running the business. Categories like cost of goods sold (COGS) and operating expenses encapsulate the expenditures incurred in the pursuit of generating income.

COGS, the bird’s-eye view of the direct costs tied to product creation, essentially outlines the expenditure of raw materials, labor, and manufacturing overhead. This figure demonstrates the efficiency of production practices, much like a skilled artist honing their craft. Meanwhile, the operating expenses unfurl into a more elaborate tapestry, including selling, general and administrative costs, marketing expenses, and research and development. Each element weaves its own narrative, revealing much about the organization’s operational ethos and strategic priorities.

The Climax: Earnings Before Interest and Taxes (EBIT)

As we reach the zenith of our financial orchestra, we arrive at Earnings Before Interest and Taxes (EBIT), an apex that encapsulates the profitability of core operations before external financing and tax obligations distort the narrative. EBIT is a critical measure that offers clarity on how well a company is managing its resources and generating profit.

This metric serves as a pivotal junction, where operational brilliance collides with financial management. It is here that management can assess whether they are effectively converting revenue into profits, similar to a conductor ensuring that the orchestra remains in sync. A healthy EBIT signifies not only operational efficiency but also potential for sustainable growth.

The Denouement: Net Income

As the composition draws to a close, we arrive at the denouement—the net income. This is the final measure, the bottom line that captures all the preceding financial actions in one poignant figure. Net income tells the story of how much profit remains after all revenues and expenses have been accounted for, akin to the final notes of a symphony echoing into silence.

The significance of net income cannot be overstated. It’s the ultimate verdict on the business’s performance and fiscal strategy, and it provides stakeholders with insights into profitability, operational efficacy, and the company’s capacity to reinvest in its future. With each tick of the fiscal clock, a company’s net income fluctuates, embodying the ebb and flow of market conditions and operational mastery.

Insights Beyond the Figures

While the numbers and totals are revealing, they often lack context. Thus, accompanying the income statement are various analyses such as the comparison to previous periods and industry benchmarks. These analyses allow for a comprehensive understanding, much like a literary critique that explores the nuances of a rich narrative.

For instance, ratio analyses such as profit margins or return on equity can provide stakeholders with a deeper illumination of operational efficiencies and investment returns. Each percentage, like a brushstroke on a canvas, contributes vital information to the overall picture of corporate health.

The Conclusion: A Financial Portrait

In conclusion, the income statement is more than just an assemblage of figures; it is a dynamic narrative that chronicles the financial journey of a business. Each section embodies a critical aspect of the enterprise’s performance, while the interplay between revenues and expenses encapsulates the essence of economic vitality. Just as a skilled storyteller crafts their tale, businesses must carefully construct their income statements, ensuring clarity, transparency, and insight.

The true beauty of an income statement lies not only in its numbers but in what those numbers signify—an intricate portrait of the challenges and opportunities that lie ahead. As stakeholders engage with this vital document, they are called to consider the broader implications of every financial decision, emphasizing the age-old adage: “What gets measured, gets managed.”