Checks, though less ubiquitous in today’s digital age, remain an enduring symbol of a financial instrument steeped in tradition. The sight of a check filled out is perhaps more than just a transactional mechanism; it represents a myriad of emotions, intentions, and depths of interpersonal trust. This article seeks to unearth the multi-layered significance of a filled-out check, drawing attention to its structure, common observations, and reasons behind the fascination with this seemingly mundane piece of paper.

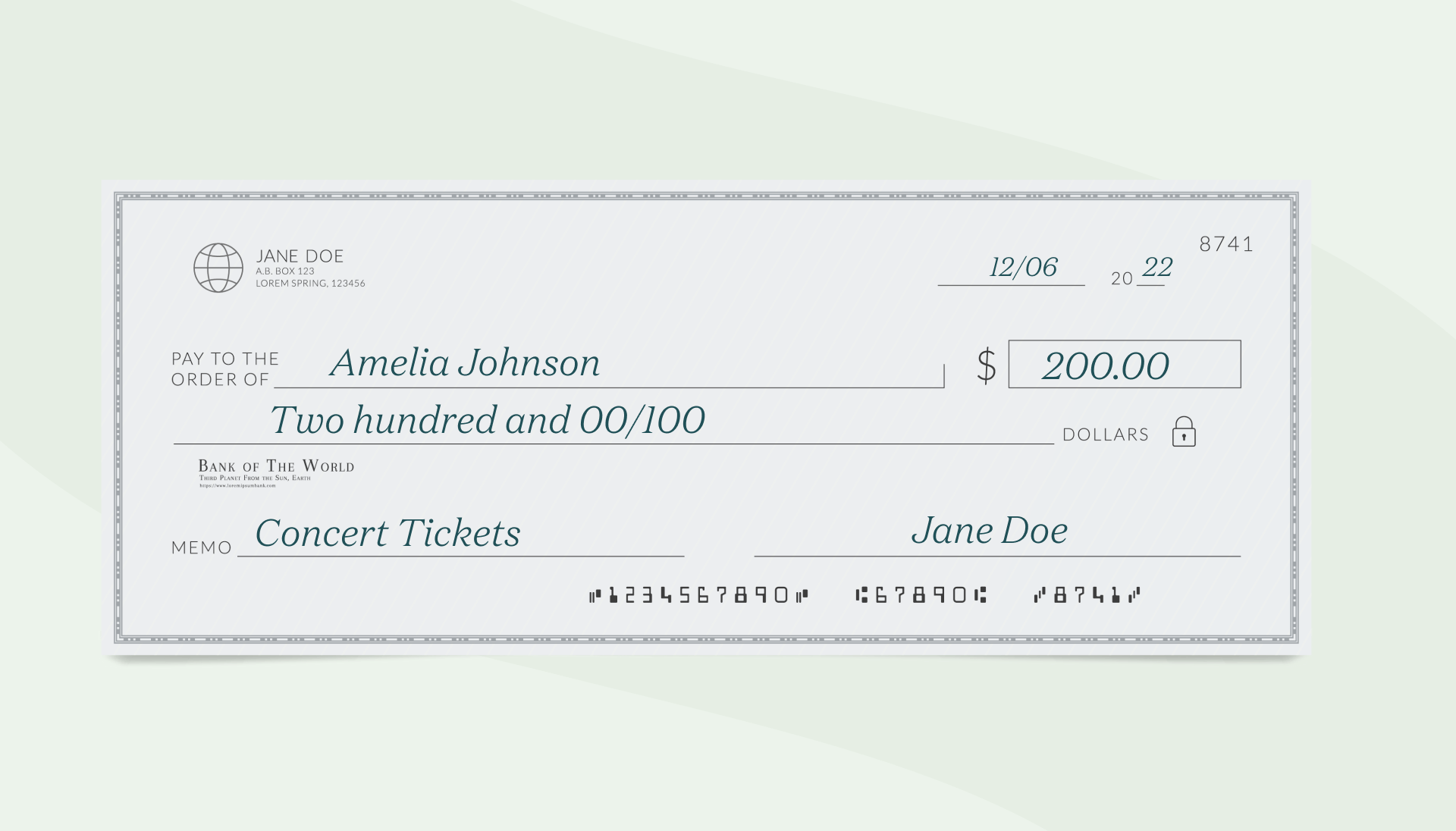

Upon first glance, a filled-out check may appear to be a straightforward document—merely a tool to transfer funds from one entity to another. Yet, as one scrutinizes its components, the intricate nature of this financial artifact begins to emerge. The typical check is divided into crucial sections: the date, payee, amount, signature, and memo line, each serving a distinct purpose. When filled out correctly, a check embodies a meticulous record, seamlessly merging functional necessity with elements of personal touch.

### The Allure of Checks: An Exploration of Common Observations

One observes a captivating sentiment that envelopes the act of writing a check. It combines the precision required in financial documentation with the personal flair unique to each individual. The embossed texture of the paper, the distinct swirls of handwriting, and the unmistakable sound of a pen gliding across the surface all contribute to an experience rich in tactile and auditory sensations. This resonates with many individuals who view the act of writing a check not as a chore, but rather as a ritual, an observable manifestation of accountability.

There exists a certain nostalgia associated with checks, harking back to a time when financial transactions were predominantly analog. This reflection invokes a sense of authenticity—a personal connection in an age where electronic transfers often lack a human touch. In this regard, the filled out check becomes a vessel for emotional resonance, signifying trust and reliance among the parties involved. It evokes reminiscences of experiences shared, whether it be reimbursing a friend, settling bills, or the thrill of gift-giving during special occasions.

### Anatomy of a Filled-Out Check

The structure of a check contributes significantly to its allure. Even as electronic transactions take precedence, understanding how to fill out a check remains an invaluable skill, not merely for practicality but as an insightful exploration into the trust between payer and payee.

- Date: The date on a check is crucial, as it signifies when the payment is authorized. It anchors the transaction in time, lending it context that may be pertinent for both the payer and payee. This simple inscription can often be overlooked, yet it acts as a reminder of the timing and urgency of financial responsibilities.

- Payee: This section bears the name of the individual or entity receiving the funds. The act of writing a name on a check is imbued with intent and recognition. It signifies a relationship, contractual or personal, that bridges the gap between two parties. To spell this name correctly is to acknowledge the importance of that connection.

- Amount: The numeric representation of payment is critical. Here, clarity reigns supreme. The inscription must be precise to avoid confusion during the processing stage. Writing the amount in words serves as both confirmation and protection against discrepancies, ensuring that the intended value is unequivocally communicated.

- Memo Line: Often, overlooked, the memo line encourages the payer to reflect on the purpose of the transaction. Whether it’s for “Rent,” “Birthday Gift,” or “Invoice #123,” this brief annotation adds a personal touch and an additional layer of context to the transaction.

- Signature: The act of signing a check represents consent and authenticity. In an era where digital signatures dominate, the handwritten signature imbues the document with identity and personal authority, grounding it in human touch and responsibility.

### Symbolism and Deeper Fascination

The fascination with checks goes beyond their transactional utility. They symbolize trust—a bridge connecting disparate individuals through the act of one party vouching for the financial reliability of another. In this sense, checks can reflect social dynamics, revealing deeper insights into relationships. Consider how a check can encapsulate feelings of gratitude, obligation, or even regret, each scenario rich with its own narrative.

Checks also reflect the evolving landscape of finance. They reveal economic realities, from personal budgeting to corporate transactions. The necessity of checks in certain scenarios persists, particularly for those who may not have access to digital banking or for transactions requiring tangible documentation. The resistance to relinquish checks stems from a desire for control and reliability, reinforcing a sentimental attachment to what is perceived as ‘real.’

### The Future of Checks

Despite the ascendency of electronic payments, the check remains relevant. Innovatively, new methodologies, such as online checks and digital checks, have emerged while preserving the ethos of traditional checks. As technology continues to advance, the fundamental principles of what a check represents—trust, accountability, and sense of community—will likely remain unaltered.

The example of a filled-out check serves as a microcosm of human relationships and financial interaction. It encapsulates complex social and psychological elements often overlooked in a fast-paced world. In observing how checks function as more than financial instruments, one recognizes the layers of significance intertwined within each stroke of the pen, fostering a deeper appreciation for this emblem of trust. It stands as a testament to both the simplicity and complexity of human transactions—a reflection of life’s intricate web of connections.