Imagine a scenario where you’ve lent a friend a considerable amount of money under the agreement that they would return it by a specific date. Suddenly, your friend disappears without notice, leaving you with nothing but a gaping hole in your finances. Frustrating, isn’t it? Now, what if you could have a legal safety net to protect your investment? That’s where bonds come into play. However, what happens when a bond is revoked? What does bond revocation mean, and what court consequences arise from this action? Let’s delve into the intricacies of bond revocation by exploring its implications, processes, and consequences.

1. Understanding Bond Basics

To comprehend bond revocation, one must first grasp the essence of what a bond is. A bond serves as a legal contract—more precisely, an agreement in which one party (the principal) secures the obligations of another party (the obligee) by posting a guarantee in the form of collateral. This collateral may take the form of cash, property, or various financial instruments. The primary purpose of a bond is to ensure that the principal fulfills their responsibilities under the contract. Bonds are ubiquitous in various sectors, including construction projects, financial transactions, and legal proceedings.

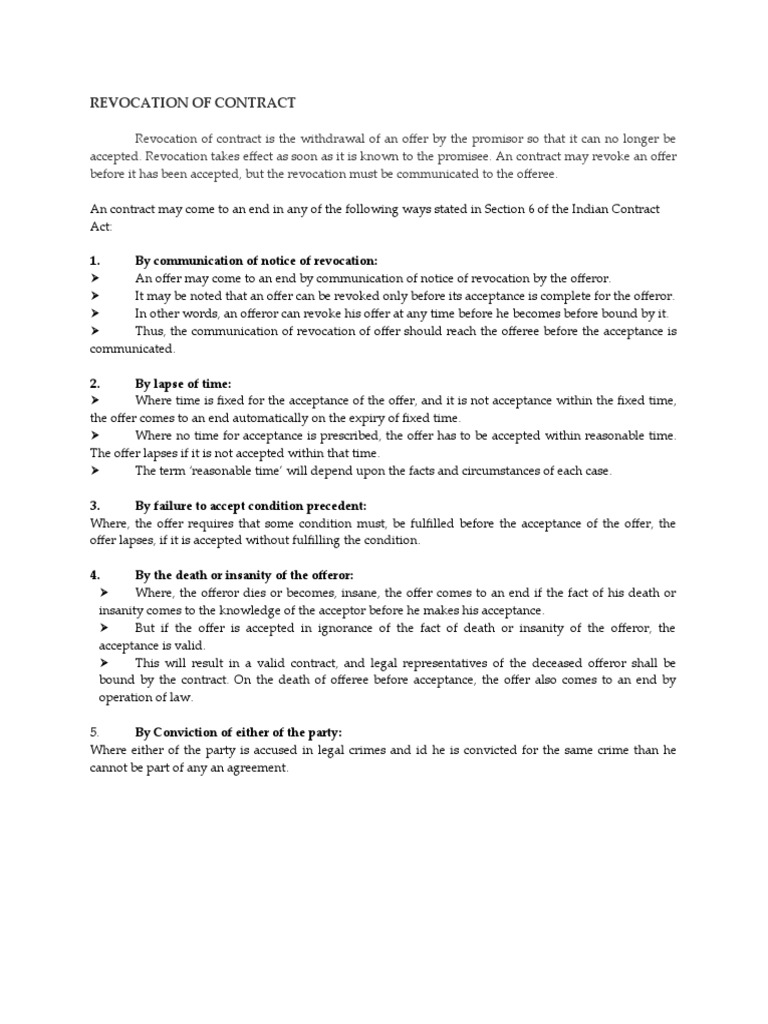

2. The Concept of Bond Revocation

So, what does bond revocation actually mean? It’s the process by which a court or an authorized entity cancels a bond previously issued, often due to a breach of the terms stipulated in the bond contract. The reasons for revocation vary widely, encompassing failure to comply with obligations, fraudulent behavior, or changes in risk assessments. When a bond is revoked, the principal is no longer afforded the protection of the bond, which can have significant legal and financial implications.

3. Common Causes for Bond Revocation

Several factors can trigger the revocation of a bond. Let’s explore some common scenarios:

- Non-Compliance: When a principal fails to meet the required obligations as dictated in the bond agreement, such as not completing a project within the specified timeline.

- Fraudulent Actions: If there is evidence of deception or dishonest conduct by the principal, trust is eroded, prompting revocation.

- Legal Violations: Engaging in illegal activities or violating laws relevant to the bond’s purpose can lead to its cancellation.

- Financial Instability: A drop in the principal’s creditworthiness or financial health can lead to a reassessment of risk and eventual revocation.

4. The Revocation Process

The revocation of a bond is not an arbitrary decision; rather, it follows a legal process. Here’s a step-by-step breakdown:

- Notification: The principal is typically notified of potential revocation through official channels, including notices from the obligee or the court.

- Opportunity to Respond: The principal may be granted the opportunity to rectify the issues leading to the revocation or to contest the revocation in court.

- Court Hearing: If disputes arise, a court hearing may be held, where both parties can present evidence and argue their cases.

- Judicial Decision: The court will evaluate the facts presented, assessing whether revocation is warranted, ultimately issuing a judgment.

5. Consequences of Bond Revocation

The ramifications of bond revocation can be severe, influencing both the principal’s financial standing and legal fate:

- Financial Liability: Once a bond is revoked, the principal may be held financially liable for any damages or losses incurred due to their non-compliance.

- Legal Penalties: Depending on the conditions of the bond and the reason for revocation, legal penalties may ensue, which could include fines or even jail time for fraudulent actions.

- Loss of Reputation: Revocation can tarnish a party’s reputation, potentially impacting future business opportunities and relationships.

- Increased Scrutiny: After revocation, the principal may face increased scrutiny and difficulty in securing future bonds or loans.

6. Exploring Alternatives to Revocation

Before reaching the point of revocation, it is often beneficial to explore potential alternatives. Here are a few avenues to consider:

- Negotiation: Open and honest communication with the obligee might reveal options for renegotiating terms or extending deadlines.

- Mitigation Efforts: Taking proactive steps to rectify issues leading to non-compliance can demonstrate good faith and lessen the likelihood of revocation.

- Seeking Legal Advice: Consult with an attorney who specializes in contract law to explore all legal options available to prevent bond revocation.

7. Conclusion

Bond revocation marks a significant legal event, often precipitated by a myriad of issues ranging from non-compliance to fraudulent behavior. The consequences can be far-reaching, impacting one’s finances, reputation, and legal standing. In a world where trust is paramount, maintaining dialogue and integrity is essential. As we navigate financial agreements, it becomes increasingly important to understand the nuances of bonds and the perilous path that leads to their revocation. By staying informed and proactive, one can avert the harsh repercussions associated with this legal concept, ensuring that agreements remain intact and beneficial for all parties involved.