What does conversion salary mean? This seemingly simple question leads us down a rabbit hole of concepts surrounding compensation, equity, and the nuances of employee remuneration. In today’s dynamic job market, understanding these terms not only demystifies salary discussions but can also empower individuals in negotiating their worth. Let’s dive into the intricate web of compensation structures and explore what conversion salary entails.

At its core, conversion salary refers to the conversion of different forms of compensation into a standardized format. It is particularly relevant in organizations that offer variable pay structures, such as base salary, bonuses, stock options, and various allowances. Have you ever pondered why some salaries are presented as annual figures while others might be quoted hourly or even in terms of benefits? The conversion salary process ensures these differing components are synthesized into a cohesive understanding of an employee’s overall compensation package.

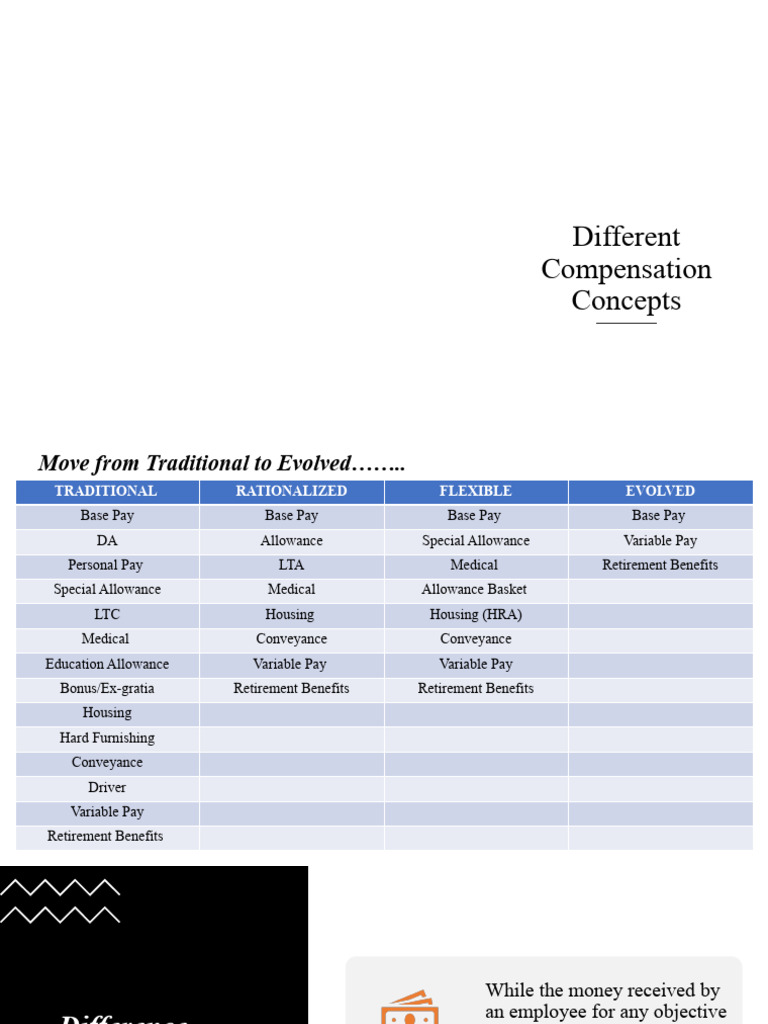

To fully appreciate conversion salary, consider the traditional pay model juxtaposed with contemporary practices. In the past, base salary often dictated the entire compensation discussion. However, as businesses evolve, so too does the complexity of compensation. Many employees now receive a fusion of cash and non-cash benefits that shape their total earnings. Understanding how to calculate conversion salary becomes crucial, especially when these benefits hold significant value.

So, what are the categories influencing conversion salary? First, we should look at the base salary, which is the foundational element of any compensation packet. Base salary is the guaranteed amount an employee earns without additional incentives. It serves as a reference point for calculating other components, such as bonuses, whose value may be contingent upon individual or corporate performance.

Next, let’s delve into variable pay elements. These may include performance bonuses, commissions, and profit-sharing. A fascinating challenge arises here: how do you quantify the potential earnings from such unpredictable categories? The answer lies in historical data and projections. Companies often analyze past performance metrics to forecast bonus eligibility, enhancing the accuracy of conversion salary calculations.

Another essential aspect is non-cash compensation, which significantly enhances an employee’s overall earnings picture. Think about stock options and equity. Startups and tech firms frequently offer these as part of their compensation strategy. However, their real-time value can fluctuate drastically. Hence, determining an accurate conversion salary that reflects both immediate and potential future earnings can be challenging.

Now, let’s not forget about mandatory benefits, which are often overlooked but are crucial when evaluating conversion salary. These include health insurance, retirement plans, and paid time off. They represent real monetary value added to an employee’s compensation package. Understanding these benefits and their impact on overall earnings can substantially shift the perception of an employee’s remuneration.

To clarify further, let’s explore how to derive a conversion salary in real-world terms. Consider an employee with a base salary of $60,000, a potential annual bonus of $5,000, stock options estimated at $10,000 annually, and mandatory benefits valued at $7,500. To arrive at a conversion salary, you would aggregate these components: $60,000 + $5,000 + $10,000 + $7,500 = $82,500. Thus, the conversion salary in this scenario would be $82,500, thereby providing a more holistic view of the individual’s compensation.

However, potential pitfalls lurk in this calculation process. The key challenge is ensuring that every element is accurately represented. Skills and experiences can skew values, while market changes may lead to fluctuations in stock options and bonus structures. For instance, if market conditions adversely impact a company’s stock, the initial assumption about stock options becomes tenuous at best. Thus, constantly updating these figures is paramount in presenting an accurate conversion salary to reflect current realities.

Furthermore, organizations must be transparent in their compensation structures to ensure equitable practices. Variability in conversion salaries can lead to disparities and dissatisfaction among staff members. Hence, developing a consistent methodology for calculating these figures assures employees that they are being treated fairly. Clarity fosters trust across the board, which is essential for employee morale and retention.

As emerging trends such as remote work and gig economies reshape the labor landscape, conversion salary is likely to evolve. For instance, with remote work gaining traction, some companies might offer different conversion salary models based on geographic cost-of-living adjustments. This creates a more adaptive compensation structure, but it also complicates the conversation surrounding fairness and equity. How should companies balance these considerations while ensuring competitive pay?

In navigating this complex topic, it’s crucial to recognize that conversion salary is more than just numbers and formulas. It encapsulates the value an organization places on its workforce and the ways in which that value is communicated. Ultimately, understanding what conversion salary means equips employees with the knowledge to advocate for themselves in ever-changing work conditions.

In conclusion, conversion salary is a multi-faceted concept that reflects the sum of various compensation elements. With the complexity of today’s job market, having a firm grasp on how to calculate and interpret conversion salaries is essential. It provides clarity, fosters transparency, and empowers individuals to negotiate effectively within their careers. So the next time you find yourself in a discussion about salaries, remember to ask: What does conversion salary truly mean, and how does it transform the way we think about compensation?