What exactly does a deposited plan mean? This term can often evoke confusion, especially for those unacquainted with the intricacies of land development and real estate transactions. Picture this: you stumble upon an intriguing property, only to be bogged down by a maze of legalities and technical jargon. Fear not! This guide will unravel the concept of a deposited plan, demystifying its significance in the realm of finance and real estate.

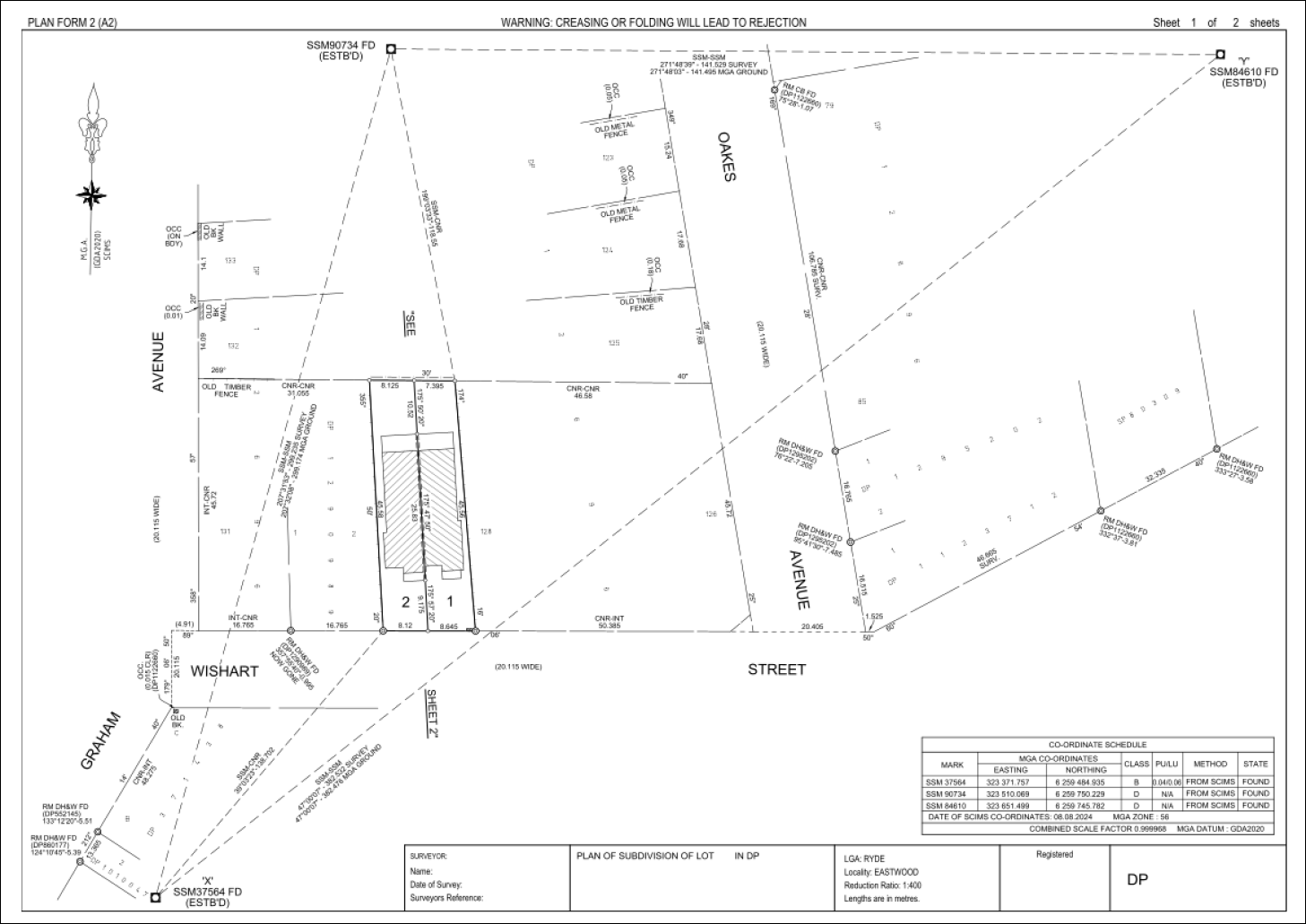

At its core, a deposited plan is a detailed blueprint that defines the boundaries and specifics of a parcel of land. But it is much more than just a mere sketch. It encapsulates vital information concerning the property’s size, shape, and any easements or encroachments that might affect it. In many jurisdictions, a deposited plan must be submitted and approved by local authorities before any construction or subdivision can occur. This leads to an essential question – how does one navigate the labyrinth of legal requirements surrounding deposited plans?

To grasp the importance of deposited plans, one must first explore their role in the land development process. When you decide to subdivide a larger piece of property into several smaller lots, creating a deposited plan becomes a crucial step. This document not only serves as a graphical representation of the subdivision but also provides necessary details that help gauge feasibility. Local planning officials scrutinize the plan for compliance with zoning laws, environmental regulations, and infrastructure provisions.

Now that we understand the function of a deposited plan, let’s dig deeper into its components. Typically, a well-structured deposited plan will include precise measurements outlining the dimensions of each lot, the location of existing structures, and other physical attributes of the land. Moreover, it will highlight access routes, drainage systems, and any amenities that may be present, such as parks or communal areas.

Here’s a critical consideration: What happens if the details in a deposited plan are flawed or incomplete? Errors in the document can lead to severe consequences. From financial setbacks due to required revisions to legal ramifications, ensuring that the plan is accurate and comprehensive is paramount. Hence, working with qualified professionals—like land surveyors and urban planners—is advisable to mitigate these risks.

Furthermore, the implications of a deposited plan extend beyond just the initial submission. Think of it as a guiding beacon throughout the property’s lifecycle. Future buyers, developers, or financiers will often reference this document when making decisions concerning property use, investment potential, or even resale value. Thus, the meticulousness applied in creating a deposited plan can pay dividends in the long run.

In many regions, deposited plans must undergo a rigorous approval process involving public consultations and assessments from various regulatory bodies. This procedure ensures that local communities have a say in how land is developed. The process can sometimes be lengthy and fraught with obstacles, leading parties to wonder: is patience a virtue or a burden when dealing with such bureaucratic red tape?

Let’s pivot to the financial implications of a deposited plan. Securing a loan for property acquisition often requires submitting a deposited plan to lenders. Financial institutions view these plans as a risk management tool, assessing whether the property meets specific criteria. A well-structured deposited plan can enhance the property’s marketability and, consequently, its financial viability. Yet, the challenge remains for many to understand the financial parameters involved in property investment, with the deposited plan serving as paramount leverage.

In some cases, particularly in urban environments, developers may seek to adapt their plans to the ever-evolving landscape of the city. Changes in zoning laws or community planning initiatives can compel them to revisit their deposited plans. How, then, can one stay abreast of such fluctuations while also ensuring that their plans remain compliant? Engaging in ongoing dialogue with municipal authorities and staying informed about local changes is indispensable for success in this realm.

The process doesn’t cease once a deposited plan is approved. It evolves as the land develops. Adjustments may be required as construction proceeds, which leads to the necessity for continual modifications to the original deposited plan. Willingness to adapt to changes is essential; flexibility often becomes a key asset in ensuring that development stays on track and aligns with regulatory expectations.

As we conclude our exploration, it is apparent that a deposited plan is a multifaceted element of the land development process. It serves not only as a historical record but also as a dynamic tool that influences property valuation, governance processes, and consumer confidence. The interplay between legal requirements, financial oversight, and community engagement creates an intricate tapestry where all threads must be woven together harmoniously. So, the next time you encounter a deposited plan, consider it a navigational chart guiding you through the vast and sometimes tumultuous waters of real estate and finance.

In essence, the world of deposited plans is rife with complexities, challenges, and opportunities. To navigate this domain effectively, one must possess not only knowledge but also the foresight to adapt swiftly. Will you embrace the challenge that comes with understanding this vital aspect of land development? The journey may be demanding, but it promises rewards for those willing to embark upon it.