In an era where the conventional wisdom surrounding retirement is rapidly evolving, the act of deferring retirement has gained considerable traction within financial planning discussions. A growing number of individuals are pondering the implications of extending their work life, often driven by intricate motivations that extend well beyond mere financial necessity. This article delves into the multifaceted aspects of deferring retirement, illuminating both the fiscal ramifications and the psychological undercurrents that fuel this intriguing phenomenon.

The Concept of Deferring Retirement

To defer retirement signifies a decision to postpone leaving the workforce until a later date than initially planned. Traditionally envisioned as a long-awaited respite from the rigors of professional life, retirement now appears less as a definitive endpoint and more as a gradual transition. The underlying motivations for such decisions can be bewildering — spanning financial security, professional fulfillment, and the pursuit of continued engagement in meaningful work.

1. Financial Considerations: The Mathematics of Deferral

One of the most palpable reasons for deferring retirement is the enhancement of financial stability. Individuals who postpone their retirement often find themselves in a more advantageous position regarding their retirement savings, pensions, and Social Security benefits. When a person chooses to stay in the workforce longer, they can accumulate more resources, enabling them to forge a more robust financial foundation.

Moreover, delaying the receipt of Social Security benefits can lead to a significant increase in monthly payments. For instance, according to Social Security regulations, for every year one delays claiming benefits beyond their full retirement age, monthly payments can increase by a notable percentage. This can lead to a markedly higher income during the twilight years, providing more flexibility in lifestyle choices and reducing the likelihood of financial strain.

2. Health and Longevity: A Growing Trend

With medical advancements and a surging emphasis on wellness, many individuals are enjoying healthier and longer lives post-retirement age. Consequently, the prospect of a lengthy retirement, devoid of professional identity or purpose, can be disconcerting. The notion of spending decades in leisure, while appealing to some, is not universally desirable. A number of people derive significant satisfaction and emotional fulfillment from their professional lives. Deferring retirement allows them to embrace continued productivity while maintaining their sense of purpose.

Furthermore, research illustrates that maintaining an active professional life can confer tangible health benefits. Engaging in work can mitigate cognitive decline and foster social interactions that enhance emotional well-being. Such factors underscore the idea that working longer is not merely an economic decision, but also a health-conscious strategy.

3. The Evolving Work Environment

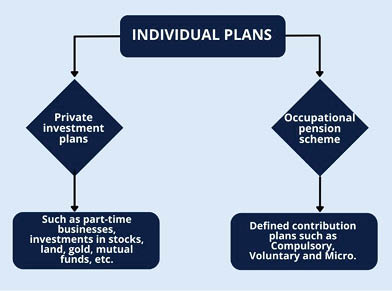

The modern work landscape has undergone a seismic transformation, characterized by greater flexibility and a proliferation of opportunities for part-time or freelance work. Unlike previous generations, who might have faced limited options post-retirement, contemporary workers are often presented with a wealth of paths to explore. The gig economy, remote positions, and consulting roles allow retirees to tailor their work engagements to suit their lifestyles, thereby making deferred retirement an appealing option.

This evolution is particularly significant for those with specialized skills or extensive experience in their respective fields. Organizations often seek the expertise of veterans, valuing the wisdom and knowledge they bring to the table. Thus, the decision to defer retirement can be viewed as an opportunity to capitalize on one’s professional prowess while contributing to society.

4. Tackling Common Concerns: Challenges of Delayed Retirement

Despite the many benefits, deferring retirement is not without its challenges. As individuals contemplate extending their careers, several concerns inevitably arise. Chief among these is the potential for burnout; juggling professional responsibilities with personal commitments can prove arduous, particularly for those already nearing traditional retirement age.

Moreover, the workforce itself can be a daunting domain for older employees. Ageism remains a pervasive issue, where seasoned professionals may encounter biases that discourage their continued employment. Navigating these challenges necessitates resilience and, often, a re-evaluation of one’s career path and ambitions.

5. Emotional and Psychological Dimensions

The emotional complexities of deferring retirement cannot be understated. While financial incentives and wellness considerations play vital roles, many individuals grapple with their professional identities. The transition from being a professional to being fully retired often entails a deep-seated psychological shift. For countless individuals, work constitutes a foundational element of their identity, and the prospect of relinquishing that can evoke feelings of loss or uncertainty.

Moreover, the concept of productivity extends beyond economic considerations; many see value in contributing meaningful work to society. By deferring retirement, individuals not only bolster their financial positions but also maintain their sense of relevance and contribution. This interplay of emotional and financial factors underlines the complexity of the decision-making process.

Conclusion: A Personal Path Forward

Ultimately, the decision to defer retirement is profoundly personal and encompasses a myriad of considerations. Understanding the financial implications, health impacts, workplace dynamics, and emotional ramifications can empower individuals to make informed choices. Each person’s journey is unique, influenced by personal circumstances, aspirations, and values. As this nuanced subject continues to evolve, it is crucial to recognize that deferring retirement can indeed offer a pathway to richer experiences, enhanced well-being, and a financially secure future. The future of work is changing, and in that transformation lies an abundance of possibilities, allowing individuals to redefine what it means to age in a professional context.