When you hear the term ROR, it might conjure images of an arcane abbreviation lost in the maze of technical jargon. Yet, like a hidden gem waiting to be unearthed, ROR holds multifaceted meanings across various domains—from finance to technology and beyond. This comprehensive exploration delves into the depths of ROR, elucidating its significance and common applications, while illuminating its unique appeal.

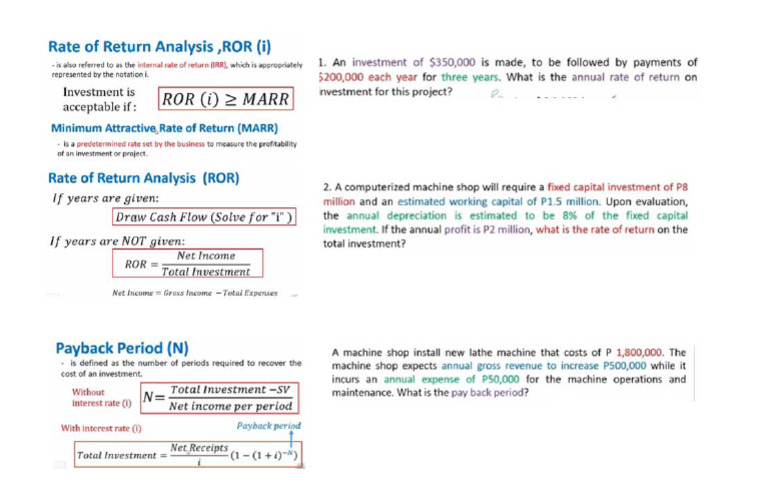

To comprehend what ROR means, one must first traverse the landscape of its prevalent interpretations. At its core, ROR most commonly stands for “Rate of Return.” This term, a beacon in the finance industry, calculates the profitability of an investment over a certain period. The rate of return serves as a compass for investors, guiding their financial decisions with insightful clarity.

The Calculative Essence of Rate of Return

Visualize ROR as a lighthouse standing steadfast against the turbulent waves of investment uncertainty. It offers a clear measure of how well an investment is performing, shedding light on gains or losses relative to the original investment amount. For instance, when you purchase a stock for $100, and later sell it for $120, your rate of return would be 20%. This represents a 20% profit on your initial capital—a gratifying outcome in the realm of finance.

In essence, ROR is not merely a number; it encapsulates the financial health of investments. Investors utilize this metric to compare diverse investments swiftly—akin to selecting the ripest, juiciest fruit from a vendor’s market stall. A higher ROR often signifies more attractive investment prospects, while a lower rate may prompt investors to reassess their strategies.

Common Uses of ROR in Finance

Beyond its elementary definition, ROR branches out into more complex territories, revealing its utility in various scenarios:

1. Investment Analysis: Financial analysts frequently rely on ROR to gauge the performance of mutual funds and individual stocks. It acts as a touchstone, allowing them to juxtapose historical data to forecast future potential.

2. Real Estate Ventures: In real estate investment, ROR assessments help investors make informed decisions when purchasing properties. Evaluating the rate of return provides a lucid understanding of expected cash flows and property value appreciation, thus helping investors allocate resources judiciously.

3. Risk Assessment: The rate of return intertwines with the assessment of risk. Higher returns typically accompany increased risk. Understanding ROR enables investors to evaluate their risk tolerance in alignment with anticipated returns.

4. Retirement Planning: Individuals preparing for retirement often consider ROR as a benchmark for the growth of their retirement accounts. A consistent positive ROR can significantly affect the financial security of one’s golden years.

Each of these uses illustrates ROR’s vital function as a navigational tool in the financial realm, enhancing decision-making and strategy crafting.

ROM: Rates of Return in Technology and Business

The Allure of Ruby on Rails

Ruby on Rails invites developers into a realm of elegance and efficiency. By employing the principles of convention over configuration, it minimizes the burden of argumentation often encountered in software development. This framework not only accelerates the development timeline but also enhances code maintainability, making it a favorite among startups and seasoned developers alike.

Moreover, Ruby on Rails embodies community-driven development. With its vibrant ecosystem, users can leverage prebuilt components and libraries, which significantly expedite the development process. This collaborative spirit stands as a testament to the framework’s unique appeal, promoting a culture of sharing and innovation.

Practical Applications of Ruby on Rails

1. Web Development: Many startups leverage Ruby on Rails for the creation of MVPs (Minimum Viable Products). Its rapid prototyping capabilities allow entrepreneurs to validate their ideas in the marketplace swiftly.

2. eCommerce Platforms: Renowned eCommerce websites utilize Ruby on Rails to manage dynamic content and user interactions. Its flexibility and scalability cater to businesses of all sizes.

3. Content Management Systems: Various content-heavy websites harness the power of Ruby on Rails to facilitate smooth content creation and management processes, driving user engagement and retention.

4. Social Networking Sites: Ruby on Rails offers an ideal framework for social media applications, combining ease of use with powerful features such as database management and user authentication.

The Multifaceted Nature of ROR

Whether navigating the treacherous seas of financial investments with the Rate of Return or embarking on a creative journey through technological realms with Ruby on Rails, ROR is a term brimming with potential and significance. Its ability to render complex ideas into measurable results makes it an invaluable asset in both personal finance and software development.

As we traverse through life’s myriad pathways—be they financial or technological—the insights garnered from ROR will remain our steadfast compass. This exploration of ROR underscores its diverse applications and the inherent wisdom it offers to investors and developers alike. By embracing ROR, one can enhance their ability to navigate the challenges and opportunities that inevitably arise in the dynamic worlds of finance and technology.